Russia's STB market to be flat at 2.5 million units in 2012

Monday, December 5th, 2011

The European Audiovisual Observatory publishes a new report “Television and on-demand services in the Russian Federation”, edited by J’Son & Partners

- The digitisation of television progresses on the various platforms: terrestrial, cable, satellite IPTV and mobile.

- The progress of digitisation aids the development of a pay-TV market.

- The development of VoD is slower than expected, but the number of services available is growing.

Implementation programs for DTT

The Russian Federation is currently implementing digital terrestrial television in the framework of two important Federal programmes. 4 phases of transition by region are planned. The Implementation of the first phase, which began with the Far East regions and southern Siberia, started in 2010, and has now been completed successfully. The deadline for the analogue switch off is set for 2015.

The planned programme budget is 127 billion RUB, i.e. about 3.8 billion USD (current exchange rate). Of this amount, it is planned to draw 80 billion RUB from the State budget, and the rest from extra-budgetary sources. The main area of expense of about 60 billion RUB will be the construction of digital terrestrial television networks. This includes the modernization of the Russian TV and radio broadcasting network (RTRN) – replacement of some existing antenna mast structures and the construction of new ones, replacement of transmitters with those suitable for digital broadcasting. The programme objectives are to provide up to 100% of the Russian population with multichannel broadcasting with the guaranteed provision of nationwide public television programmes of appropriate quality, as well as improving the operational efficiency of broadcasting.

The issue of transition to the new DVB-T2 standard in Russia has become especially relevant after the discussion at the meeting of the Government Commission for TV and Radio Broadcasting Development on July 7, 2011. The Commission supported the proposal of the Ministry of Communications on pilot deployment of the terrestrial network for the digital terrestrial television broadcasting standard DVB-T2.

Development of the pay-TV market

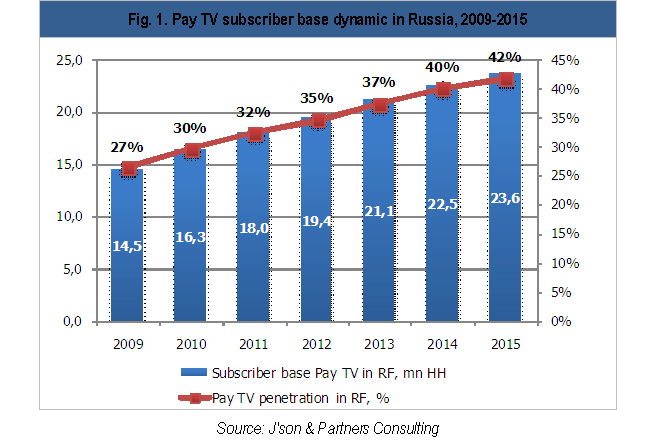

Meanwhile the non-terrestrial pay-TV market continues growing. According to J’Son and Partners, 32% of Russian households subscribe to a pay-TV offer in 2011 and the level should reach 42% in 2015. The development of pay-TV is mainly due to the activity of Russian satellite television operators (“Tricolor TV” and others) which offer a considerably low subscription price, with large and diversified packages. IPTV, a relatively new segment of pay TV, which has great opportunities for interactive services, is trying to enlarge its subscriber base while maintaining high prices for the access to the content.

Pay TV market key players in Russia, 2010

Type of Subscribers HH Revenue Holding broadcasting millions million USD ------- ------------ ----------- ----------- Tricolor TV Satellite 5.1 92 MTS (inc. COMSTAR-UTS and Multiregion) Cable, IPTV 2.92 112 Divan-TV (ER-Telecom) Cable 1.2 58.6 NTV+ Satellite 0.63 163.8 Rostelecom (inc. macroregional branches) Cable, IPTV 0.51 30.6

Source: J’son & Partners Consulting, companies data

The number of Russian IPTV subscribers by the first half of 2011 reached only 0.7 million households which is 4% of whole pay TV base. The company “Rostelecom” which is actively developing IPTV in its inter-regional companies could change this situation: it is increasing the number of channels proposed, while adding free services and buying up programme rights.

Current Pay TV subscribers base evolution in 2010 – H1 2011 (million households)

2010 H1 2011

------- -------

Total 16.3 18.1

Satellite 6.3 7.5

Cable 9.6 9.9

IPTV 0.44 0.7

Source: J’son & Partners Consulting, companies data

A considerable decline in sales of set-top-boxes was registered in 2009 but there was a gradual recovery in 2010. The total installed basis of set-up boxes will exceed the before-crisis level by 11%.

The development of the VoD market

IPTV became a starting point for non-linear TV closed systems development in Russia – “video on demand” services (VOD), the main business models of which are “pay per view” (PPV) and “subscription” (SVOD). Almost all major Russian operators of pay TV and also mobile networks offer services which allow viewers to choose a film from a general or thematic provider’s catalogue.

The difficulties in the acquisition of license rights to the content, the necessity for a consumer to make a double payment (to a provider to get access the content and for the film itself) make VOD services uncompetitive at the moment with a similar service in open systems – over-the-top (OTT), in which the content is available to any internet user: via connected TVs (for example Yota Play service), on video portals (including free ones such as Ivi, Tvingle, Zoomby), on mobile phones (Omlet.ru, Trava.ru). The new strategy of broadcasting assumes a transition from a one-to-one business model (“closed network – closed device”) to a many-to-many business model (“closed and open network – closed and open device”).

The exclusion of media service providers from the content supply chain makes the cost of the service considerably cheaper and provides an opportunity to admit more content producers to the market. This service makes it possible to obtain more information about consumers and also to lead effectively targeted advertising campaigns with high CTR. The TV development in social networks (social TV) which is already widely spread in the West will greatly contribute to this. Providers of interactive television services are adopting the strategies of interaction with Facebook and Twitter users, new interactive shopping services are appearing etc. The scale of the video viewing market promises positive perspectives for interactive services: at the moment in Russia there is one of the largest online video audiences: by June of 2011 there were 41 million people, while, for example, in Great Britain about 34 million and 40 million in France.

Set-top-Box market: market size in monetary and in volume terms, its main producers and consumers

More than 2 million units of customer STB equipment were sold in 2010 for over 185 million USD.

2010 was the first year in the Russian market of STB terminal equipment, during which the share of IPTV set-top boxes significantly increased. Primarily, this is due to growth of subscriber base of IPTV providers, caused by the fact that the Russian broadband providers have begun increasingly developing Pay TV, digital TV and IPTV services.

In the coming years J’son and Partners Consulting expects the continuation of this trend. However, the quantity of DVB-S set-top boxes sold is still very significant, due to the fact that satellite TV operators have a much greater coverage of the target audience than TV providers using physical wire connection.

Sales of subscriber equipment in physical terms by type, 2007-2012 (millions of units):

Actual Forecast

---------------------- ----------

2007 2008 2009 2010 2011 2012

---- ---- ---- ---- ---- ----

Satellite 0.5 1.9 1.7 1.5 1.6 1.6

Cable TV 0.2 0.2 0.2 0.2 0.3 0.3

IPTV 0.1 0.1 0.1 0.5 0.6 0.6

---- ---- ---- ---- ---- ----

0.8 2.2 2.0 2.2 2.5 2.5

Source: J’son & Partners Consulting

Substantial growth in STB sales in 2010 happened due to the growth of Pay TV market and the end of the world economic crisis.

In 2010, five leading players occupied about 85% of the market:

• Digi Raum Electronics (35%)

• General Satellite (28%)

• HUMAX (11%)

• Smartlabs (7%)

• Elecard (4%)

The rest was made up of:

• ZTE (3%)

• Amino Communications (3%)

• ZYXEL (2%)

• COSHIP (2%)

• Realcube (2%)

• Others (3%)

At the same time, more than 35% of sales in quantitative terms are the sales of satellite receivers made by Digi Raum Electronics.

The main consumers of the terminal STB equipment are the operators, who buy them for resale to their customers. Below are the main consumers of different STB devices:

STB vendor collaborations with Pay TV operators in Russia

Vendor Operator ------ -------- DRE, General Satellite Тricolor-ТV Amino МТS, DiSeL-TV (Rostelecom) Arion Divan-ТV (ER-Теlеcоm) GS, Topfield HD platform Topfield Orion express DRE, Humax, Topfield Raduga ТV Smartlabs TVi (Rostelecom) Motorola, Cisco Systems Beeline ТV Amino, Realcube QWERTY Zyxel, Elecard ТWist (Rostelecom) Zyxel Ðvangard ТV Humax Ðkado Elecard Tomika, Neotelecom, ТТК, Sibinet, Fast70net, ТОМТЕL, New Telesystems INFOMIR J-TV (Rostelecom)

Source: Company data

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge