Cable STB sales perk up in 1Q14

Monday, June 16th, 2014

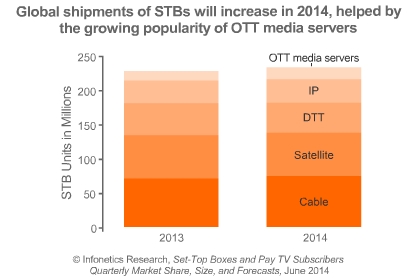

OTT media servers set to soar in China and emerging markets

CAMPBELL, California — Market research firm Infonetics Research released excerpts from its 1st quarter 2014 (1Q14) Set-Top Boxes and Pay TV Subscribers report, which tracks IP, cable, satellite, and digital terrestrial (DTT) set-top boxes (STBs), and over-the-top (OTT) media servers.

ANALYST NOTE

“There was a pocket of strength in the set-top box (STB) market in the seasonally weak first quarter. North American cable operators stepped up spending again on top of successive sequential revenue increases as they transitioned higher-end multiplay subscribers to headed and headless video gateways and replaced aging, power-hungry standard-definition boxes with more efficient high-definition boxes,” says Jeff Heynen, principal analyst for broadband access and pay TV at Infonetics Research.

Heynen adds: “A boost in overall STB unit shipments this year will come from an increase in over-the-top (OTT) media servers as service providers in China and other emerging markets use these devices to deliver live streaming TV.”

Heynen adds: “A boost in overall STB unit shipments this year will come from an increase in over-the-top (OTT) media servers as service providers in China and other emerging markets use these devices to deliver live streaming TV.”

SET-TOP BOX MARKET HIGHLIGHTS

- Worldwide set-top box (STB) revenue totaled $4.8 billion in 1Q14, a decline of 3% from 4Q13

- Cable STBs were the only segment to see unit and revenue growth in 1Q14, each up 5%

- Arris Group finished 1Q14 as the STB market share leader for the 3rd consecutive quarter, benefitting from the high-definition (HD) cable STB refresh cycle underway at North American cable operators

- North America today commands the largest portion of STB revenue, but Asia Pacific is projected to close to within 3 percentage points by 2018, driven by a penetration of advanced services such as HD and OTT, which will set in motion an upgrade cycle

- Infonetics forecasts the OTT media server segment to grow from 6% of global STB revenue in 1Q14 to 14% by 2018

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge