4K TV panel shipments to reach 40 million units this year

Thursday, May 28th, 2015

Global TV Panel Shipments to Reach Record of 265 Million Units in 2015, IHS says

- 4K TV panel shipments to reach 40 million units this year, with 15 percent penetration

SEOUL, South Korea — TV panel shipment targets will reach an historic high in 2015, despite the strengthening dollar against other currencies, especially those of the Commonwealth of Independent States (CIS) and emerging markets. According to IHS (NYSE: IHS), the leading global source of critical information and insight, TV panel unit shipments are expected to grow 5 percent, year-over-year, reaching a record 265 million units in 2015. The total panel area for TV display shipments is expected to increase 9 percent in 2015 over the previous year.

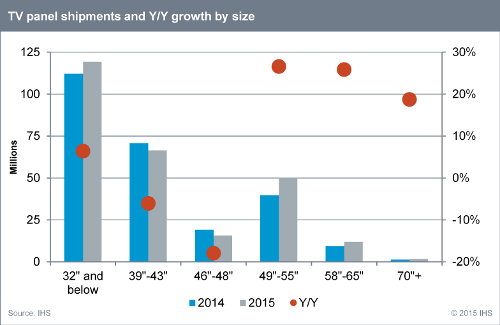

Due to strong consumer demand for larger TVs and 4K resolution, TV manufacturers are concerned about possible tight panel supplies, even though the rising dollar is cutting TV import prices. The trend toward larger sizes is also causing changes in the production mix. According to the IHS Quarterly Large-Area TFT Panel Shipment Report, due to increased demand for bigger TVs, 27 percent year-over-year growth is expected for larger displays of 49 inches to 55 inches; displays between 58 inches and 65 inches are expected to grow 26 percent; while displays smaller than 40 inches will grow less than 2 percent.

“Global first-tier TV brands, like Samsung and LGE, are sticking to their aggressive shipment plans for 2015, while Samsung Display and LG Display have less room to increase volume to meet area demand from their captive customers’ demand for larger TV panels,” said Yoonsung Chung, director of large-area display research at IHS. “These two Korean panel makers could experience a tightening of capacity in the second half of 2015, because of planned production-line adjustments.”

Other panel manufacturers, particularly in China panel makers are set to increase their 2015 TV panel business targets; however, there is a fear of increasing inventory as the gap between TV panel shipments and television shipments is widening. Because of slowing sales of televisions, combined with the effects of the strong U.S. dollar, there is a possibility TV brands might lower their business targets. “Global TV brands have factories all over the world, but TV panels are mainly manufactured in East Asia and traded in U.S. dollars,” Chung said. “Since panels comprise the largest portion of TV material costs, when the dollar is strong, television brands suffer.”

The shipment target for 4K TV panels is also expected to reach a record high this year. In all 40 million units are targeted in 2015 with 15 percent penetration. 4K TV panel shipments are expected to grow 108 percent this year, and Korean panel makers expect to lead the 4K TV panel market with 57 percent share, followed by Taiwanese manufacturers at 27 percent, and Chinese manufacturers at 12 percent.

The IHS Quarterly Large-Area TFT Panel Shipment Report provides the latest panel shipment numbers, based on surveys of large-area panel makers. The database includes quarterly shipments including four quarter forecasting of all major thin-film-transistor liquid-crystal-display (TFT LCD) suppliers, detailing revenues and average selling prices, as well as shipments by unit, display area, application, size and aspect ratio for each supplier. For information about purchasing this report, contact the sales department at IHS in the Americas at (844) 301-7334 or AmericasLeads@ihs.com; in Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or technology_emea@ihs.com; or Asia-Pacific (APAC) at +604 291 3600 or technology_APAC@ihs.com.

Connect with IHS at booth number 1117 at 2015 SID Display Week 2015 in San Jose, California, June 2 – 4, 2015, to learn more about the small-medium display market.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization