U.S. pay TV cord-cutting fears validated by Q2 losses

Tuesday, September 1st, 2015

U.S. Pay TV Cord-Cutting Fears Validated by Subscriber Losses in Q2 2015, IHS Says

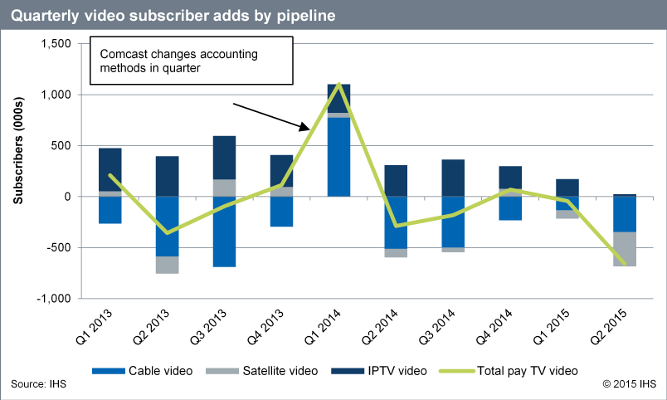

SANTA CLARA, Calif. — Validating industry cord-cutting fears, in the second quarter (Q2) of 2015, pay TV companies in the United States posted their worst ever quarterly video subscriber losses, shedding 658,450 subscribers. According to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight, Q2 2015 is the first time non-cable pay TV operators lost video subscribers, since satellite operators entered the pay TV business in the early 1990s.

Internet-protocol television (IPTV) operators posted minimal positive subscriber growth of less-than 1 percent in Q2 2015, compared to 4 percent in Q2 2013 and 3 percent in Q2 last year. Satellite operators and cable company subscriptions, however, declined less than 1 percent year over year. “Until the fourth quarter of 2014, IPTV had been the only pay TV category to experience growth; however, by Q2 of this year, IPTV’s significant forward momentum had been lost,” said Erik Brannon, principal analyst of television media for IHS Technology.

Cable operators showed a very slight improvement in Q2 2015 over Q2 2014, as the effective bundling of faster-than-IPTV broadband and video gave cable TV companies a small local advantage over IPTV. “In much the same way that cable companies had to make room for satellite and IPTV operators, the maturity of IPTV is a signal that U.S. pay TV companies must now strike a balance with over-the-top TV offerings,” Brannon said.

According to the latest IHS State of the US Pay TV Operator Market report, both of the satellite operators in the United States lost significant numbers of video subscribers in Q2 2015. Although Dish attempted to mask losses by including Sling TV subscribers, IHS estimates that the company lost 285,000 total subscribers, while DirecTV lost 133,000, without NFL Sunday Ticket promotions to fall back on.

AT&T U-verse TV experienced its first quarterly loss in Q2, and the company now claims to be focused mainly on high-value subscribers. “AT&T competes with the larger cable operators that are becoming more savvy,” Brannon said. “However the company is less effective against both Comcast and Time-Warner Cable, because U-Verse cannot match the broadband speeds offered by those companies, its service is no longer new in the pay TV market and its prices are very similar to incumbent cable subscriptions.”

For information about purchasing the latest IHS State of the US Pay TV Operator Market report, contact the sales department at IHS in the Americas at +1 844 301 7334 or AmericasLeads@IHS.com. Europe, Middle East and Africa (EMEA) at +44 1344 328 300 or technology_EMEA@ihs.com or Asia-Pacific (APAC) at +604 291 3600 or technology_APAC@ihs.com.

Latest News

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization

- Meta opens Quest OS to third-party hardware makers

- Aferian to implement further cost reductions at Amino

- Paramount to exclusively represent SkyShowtime advertising sales