Mexico leads Latin America's VOD OTT market

Monday, September 7th, 2015

VOD OTT Subscribers To Reach 5 Million In Mexico By End 2015

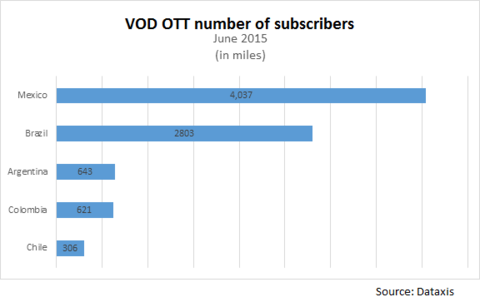

MEXICO — Dataxis, the leading intelligence company on the Latin American TV market, forecasts that Mexico will reach 5 million VOD OTT subscribers by end 2015, largely surpassing Brazil, Colombia and Argentina. Mexico has the most developed IP and TV everywhere multiscreen television platforms and the highest investment of the region. Most of the companies present in the market will participate in NexTV Summit Mexico 2015, organized by Dataxis in the Sheraton María Isabel Hotel, on September 30th and October 1st.

Will be present at the two day conference: Executives of Netflix and Clarovideo, which have most of their Latin American activities in Mexico, as well as of Grupo Televisa, Sky, Cablevisión, Dish, Telmex, Megacable, Axtel, Totalplay, TV Azteca, the international media groups Fox, Turner, Discovery and newly free-to-air licensed Cadena 3 (Imagen Multimedia group) and Grupo Radio Centro.

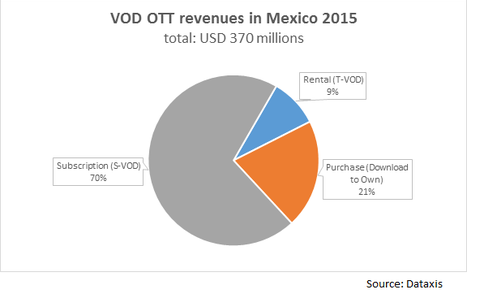

According to Dataxis, VOD OTT subscribers – like Netflix and Clarovideo – and movies rentals and purchases added together, Mexico online video services market will reach USD 370 million in 2015 and up to USD 809 million in 2018, which represent the biggest market in Latin America. Mexico is the only country of the region where Pay-TV operators succeeded in splitting Premium TV everywhere services (such as Dish online or Sky Bluetogo Video Everywhere) and billing them separately something that was never achieved by companies in other Latin American markets.

Mexico’s Clarovideo is the Latin American OTT company that produces the largest amount of original content, similar to Nexflix in the United States. Morover, the Clarovideo and Telmex broadband package has brought a growth of almost half million in trimestral subscribers during the first half of the year. At the beginning of January, Netflix had a 64% market share and Clarovideo 32%. At the end of June, the Slim’s company had reached a 39,7% market share while the American company fell to 55.7%

The cut throat competition in the broadband market is one of the drivers of the new TV services on internet. According to Dataxis estimates, Mexico had 14 millions broadband connexions at the end of June. Following important acquisitions that occurred in the Cable TV market, Grupo Televisa is now the second player with 16.4% of the accesses, including all Televisa Telecom operators. Telmex subscribers has decreased from 70% market share at the beginning of 2014, to 63.4% in 2015.

The boom of the broadband market in Mexico impacted deeply on the development of TV distributions platforms and technologies, with new access devices like smartphones and Smart TVs. This new edition of NexTV Summit will include a special executive panel where the CTOs of those big companies will debate of the future of TV.

Latest News

- Sinclair launches 'Broadspan' datacasting platform

- U.S. households report consuming 43.5 hours of video per week

- A1 Group brings Netflix to six more group countries

- Brightcove introduces Smart TV SDKs for Roku, Samsung and LG devices

- Amagi and Argoid AI drive TV program scheduling automation

- KERV and Magnite programmatically deliver AI-powered interactive video ads