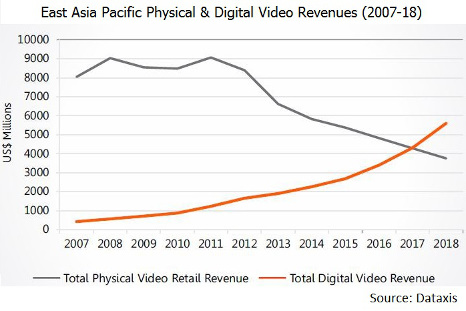

Digital video revenues to overtake physical video in East Asia Pacific by 2017

Friday, September 11th, 2015

Digital video revenues of US$4.3 billion to overtake physical video in East Asia Pacific markets by 2017

- Dataxis research analyzes digital and physical video markets of Australia, Hong Kong, Indonesia, Japan, Malaysia, New Zealand, Philippines, Singapore, South Korea, Taiwan, Thailand & Vietnam

SINGAPORE — The video markets of 12 East Asia Pacific countries tracked by Dataxis are forecast to generate total digital video revenues of US$4.31 billion in 2017 – surpassing the physical video market for the first time driven by fast-growing, high-speed broadband penetration.

A new report from Dataxis “APAC Video Market 2015” analyzes the transformation of the video market across the 12 countries covered over the period 2007-18, including physical and digital video unit sales, rentals, revenues and forecasts, as well as profiling each market and the individual digital video services available.

For example, Japan and South Korea generated about US$400 million in digital video revenues in 2007 – (96.7% of the region’s digital total) mostly from digital video rentals as Download-To-Own and Subscription-VOD (S-VOD) services only began to take hold from 2010.

By 2014, however, digital video revenues in Japan and South Korea had risen to US$1.92 billion with S-VOD particularly popular on mobile devices in Japan. Dataxis estimates that Japan had 10 million S-VOD subscribers end-2010 and should see a ramp in growth with the expected launch of Netflix by end-2015.

The four main markets in the region (Australia, Japan, New Zealand and South Korea) together accounted for about 96% of total digital and physical video revenues end-2014, with Australia and Japan alone generating about US$5.4 billion in physical video revenues, representing more than 90% of total physical revenues across the region.

However, Southeast Asia is plagued by piracy and the official physical video market is almost negligible. Unauthorized CDs, VCDs, DVDs and CD ROMs proliferate due to the lack of affordable digital content and low disposable incomes. Indonesia, for example, had 5.75 million Pay-TV subscribers end-2014, but only two Pay-TV players offered VOD services and Dataxis estimates that just 1.5% of Indonesian TV households will be VOD-enabled by 2018.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization