Germany audiovisual market set to top €10 billion

Wednesday, October 21st, 2015

VPRT Forecast for the German Media Market in 2015 – audiovisual media set to top the 10 billion euro mark

- Generating revenue growth of 5.5%, audiovisual media are the driving force behind creative industries

- Television advertising revenue up 2.5% to 4.4bn euros, in-stream video advertising up 23% to 307m euros

- Radio advertising revenue +/- 0% at 740m euros, in-stream audio advertising up 26% to 10m euros

- Teleshopping revenue up 4% to 1.8bn euros

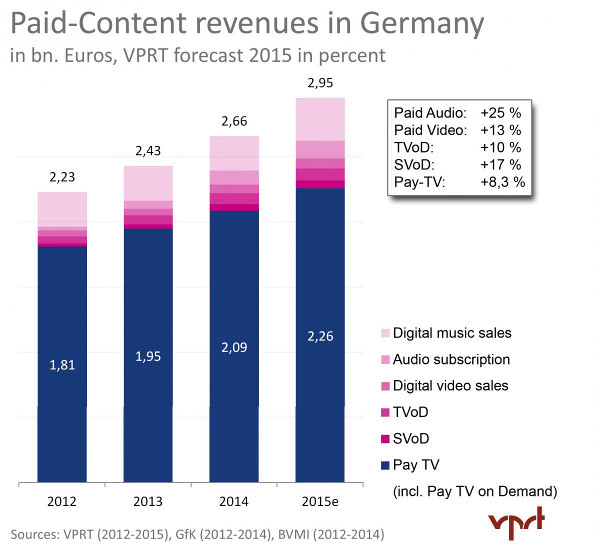

- Pay-TV & paid VOD revenue up 8.5% to 2.4bn euros

BERLIN — For the first time, the revenue generated by audiovisual media enterprises in Germany will exceed the 10 billion limit in 2015, according to the latest market forecast published by the Association of Commercial Broadcasters and Audiovisual Services in Germany (VPRT). “Companies in the audiovisual media sector are making an impressive statement in terms of their capabilities and their key role as a driving force behind both the German and European creative industries,” says VPRT Chairman of the Board, Dr. Tobias Schmid.

VPRT has published this year´s market forecast for 2015, along with the supplementary VPRT publication “Audiovisual Media Revenues in Germany”, to coincide with the start of the Munich media conference “Medientage München”. In its report, the Association envisages 5.5 percent growth for the full year based on total revenue of 10.2 billion euros across all segments of the audiovisual media market included in the forecast.

In the field of television advertising, it is expecting net growth of approx. 2.5 percent for 2015, up to 4.4 billion euros. This means that, in terms of revenue, television remains by far the strongest performer in the German advertising market. According to VPRT´s forecasts, total revenue from TV and video advertising (both linear and non-linear) will increase by 3.7 percent to reach some 4.7 billion euros.

In the case of radio advertising, VPRT anticipates a stable performance and net advertising revenue of 740 million euros for the full year 2015. Total revenues from both radio and audio advertising (linear and non-linear) are however expected show a slight rise of 0.3 percent to around 750 million euros.

Net advertising revenue from online and mobile display advertising should grow by 2.4 percent in 2015, reaching approx. 1.4 billion euros. (Online display advertising: +1 percent, mobile display advertising: +16 percent). In the teleshopping sector, the Association anticipates an increase of approx. 4 percent to around 1.8 billion euros.

For pay-TV, VPRT is forecasting growth of 8.3 percent, whereby revenue in the segment of subscription video-on-demand services (SVOD) should rise by about 17 percent and by about 10 percent in the transactional video-on-demand segment. Overall this results in a forecast growth in revenue of 8.5 percent for pay-TV and paid VOD up to around 2.4 billion euros, and up to approx. 2.5 billion euros including digital video sales. In the case of paid audio, growth of around 25 percent is expected, up to around 0.5 billion euros, which means that the total revenue generated by paid audiovisual content will reach almost 3 billion euros.

Claus Grewenig, Managing Director of VPRT said: “The current figures demonstrate the high relevance of our industry for the national economy. The positive development also makes it an economic policy objective. In view of increasing international competition, the ongoing competitive strength of media enterprises based in Germany will, however, depend above all on the creation of a level playing field.”

Frank Giersberg, Member of the Management Board and responsible for Market and Business Development at VPRT, said: “For the first time, the total annual revenue generated by audiovisual media will exceed 10 billion euros in 2015. The highest percentage growth can be seen in the sector of on-demand offerings, the largest increases in absolute figures being recorded by linear offerings, which continue to be the segments reporting by far the highest revenue.”

Revenue forecast* for German audiovisual media in 2015

Revenue Change Change

2015e 2015e vs. 2014 2015e vs. 2014

in €m in percent in €m

------------- -------------- --------------

Audiovisual advertising €5,456m +3.2% +€168m

Radio & audio advertising €750m +0.3% +€2m

Radio advertising €740m +/-0% +/-€0m

In-stream audio advertising approx. €10m +26% +€2m

Video advertising €4,706m +3.7% +€166m

Television advertising €4,399m +2.5% +€109m

In-stream video advertising €307m +23% +€57m

Paid content (A/V) €2,950m +11% +€292m

Pay-TV & pay-TV on-demand €2,257m +8.3% +€172m

Paid video (SVOD, TVOD & EST) €229m +13% +€27m

Paid audio (SAOD & EST) €464m +25% +€93m

Teleshopping €1,830m +4.0% +€70m

------------- -------------- --------------

Audiovisual media** €10,237m +5.5% +€531m

* Figures forecast for the entire German market for the whole of 2015

** Not yet included under “audiovisual media” is other revenue generated by audiovisual enterprises (e.g. from rights trading or licences) or fee income on the part of public service broadcasters. Nor has account been taken of revenue generated at upstream or downstream stages of the value chain (producers, networks, platforms, devices, agencies, service providers etc.).

Source: VPRT Forecast

In addition, audiovisual media stimulate multiple revenue at upstream and downstream stages of the value chain. “In all, we estimate this revenue effect at no less than 80 billion euros per year. Audiovisual media are a driving force behind the creative industries and have therefore become a relevant factor for the German economy as a whole,” confirms Mr. Giersberg.

Experts interviewed for the VPRT forecast anticipate a significant increase in the demand for professional radio and audio, as well as TV and video content during the years 2016 to 2021. The relevant reach is also to be recorded in a more comprehensive manner in future, following the introduction of convergent measurement models, with the result that audiovisual media are expected to acquire further shares of the advertising market. Sustained positive performance is also anticipated in the segments of pay-TV, paid audio and video-on-demand, as well as teleshopping. The extent to which the value-added potential can be realised within Germany depends, in the view of market participants, above all on the creation of a level playing field in terms of competition.

Further data and forecasts are presented in the VPRT publication “Audiovisual Media Revenues in Germany”. Appearing once a year, this VPRT market forecast is based on a survey among executives employed by German media enterprises. The basis for evaluating this year´s forecast consisted of responses from 52 companies received over the period of the survey between 25 September and 16 October 2015.

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge