Brazil Pay TV market to reach 28 million households by 2018

Monday, October 26th, 2015

Brazilian Pay TV market to reach 28 million households by 2018

- Dataxis’ latest research series reveals the size, market dynamics and projections for LatAm’s largest market

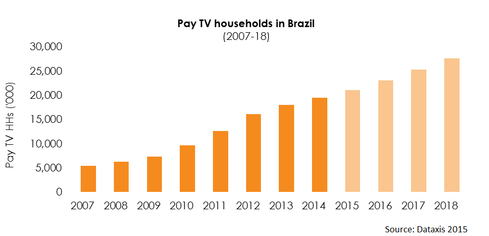

BUENOS AIRES — The Brazilian pay TV market will reach 27.7 million households (HHs) by 2018, according to data published today by Dataxis. This figure will represent a 30.7% increase when compared to end-2015.

According to the new report “Pay TV Series 2015: Brazil”, households with DTH pay TV services will account for 60.9% of total Pay TV HHs in Brazil in 2015. Dataxis forecasts that DTH will remain the leading delivery network by 2018, although its market share will diminish over the years, due to a challenging economic environment, along with an increased competition.

In this sense, CATV networks will decrease their market share from 37.7% in 2015 to 36.3% in 2018, while IPTV will grow from a 1.4% share in 2015 to 7.4% by 2018.

Although Brazil is the country with the largest pay TV subscriber base in Latin America, pay TV household penetration will remain relatively low at 32.4% by end-2015. Dataxis believes that the proportion of households with Pay TV services will rise to 40% by 2018.

At the end of Q2 2015, América Móvil group – Owner of Net and Claro TV – dominated the market with 51.7% share, followed by AT&T (Sky) with 28.8%. In a distant third place, Brazilian company Oi reached 6.1% of total pay TV market.

In turn, Dataxis forecasts that total pay TV revenues will reach USD10.26 billion by 2018, with total ARPU (Average revenue per user) around USD32. DTH services will generate 61.7% of total revenues, CATV operations will represent 33.3% and IPTV the remaining 5%.

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge