Young Canadians embrace streaming, abandon live TV

Wednesday, March 16th, 2016

Canadians with cable television are upset at paying for channels they do not watch, and a majority would consider getting a “skinny basic” package

VANCOUVER, BC — The way in which Canadians are watching television is changing, with Millennials leading the way in the adoption of streamed content, a new Canada-wide Insights West poll has found.

The online survey of a representative national sample also shows that most Canadians who have cable television at home are disappointed with the amount of money they pay for the service each month.

Time Spent Watching TV

Canadians spend, on average, 21 hours a week watching television. Men are watching more TV than women (22 hours to 20 hours).

Television viewership increases with age and decreases with income. Canadians aged 18-to-34 watch less (16 hours a week) than those aged 35-to-54 (18 hours) and those aged 55 and over (23 hours). Conversely, Canadians who live in households with an annual income of less than $50,000 watch more television (25 hours) than those in the higher brackets (19 hours and 18 hours respectively).

Across the country, Ontarians and Atlantic Canadians spend the most time watching television (24 hours a week each), followed by Albertans (22 hours), and residents of Quebec, Manitoba and Saskatchewan (21 hours). British Columbians watch the least television, at 19 hours a week.

How We Watch TV

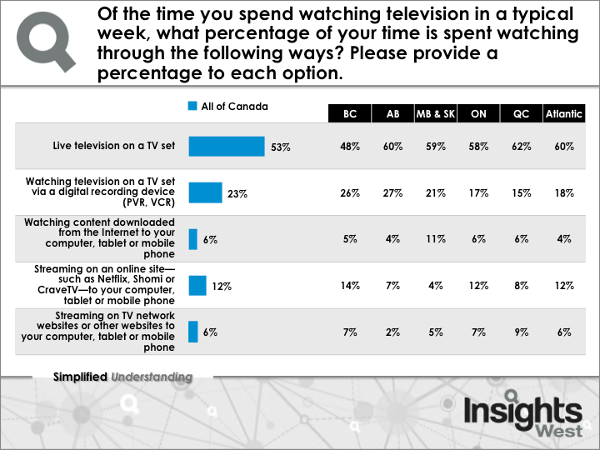

More than half of Canada’s TV time (53%) is spent watching it live on a television set, while almost a quarter of the time (23%) is spent watching television via a digital recording device.

There are some clear differences among age groups. Canadians aged 55 and over watch most of their television live (63%), but the proportion drops to 47% for those aged 35-to-54.

Canadians aged 18-to-34 are the least like to watch television live (25%), and the most likely to stream content from sites such as Netflix, Shomi or CraveTV to a computer, tablet or mobile phone (31%, compared to 14% among 35-to-54 and 7% among 55 and over). Millennials also stream more on network sites (7%) or other websites (10%) than older Canadians.

“Canada’s youngest adults are already moving away from live television and finding content through other sources,” says Mario Canseco, Vice President, Public Affairs, at Insights West. “Almost half of their television viewing time is now happening on a computer, tablet or mobile phone, a fact that will force advertisers to find a different way to communicate with them.”

Quebecers watch the most live television (62%, followed by Albertans and Atlantic Canadians with 60%), while British Columbians are last in this category (48%). In fact, British Columbians are streaming more from Netflix, Shomi or CraveTV (14%) than residents of any other province or region.

Perceptions of Cable TV

Canadians who subscribe to cable television are dissatisfied with two issues: 90% say there are many channels included in their current package that they never watch; and 88% claim to pay too much for the service.

Half of Canadian cable subscribers (50%) say they watch Canadian networks every day. More than a third also watch news channels (38%, and 51% among those aged 55 and over) and American networks (36%) daily.

Sports channels are watched every day by 18% of Canadians (and 31% of men), while lifestyle channels are watched daily by 16% of Canadians (and 19% of women).

Three-in-five Canadian cable subscribers (63%) say they are disappointed with the variety of programming they are getting from their cable television plan. The proportion rises to 76% in Manitoba and Saskatchewan, and drops to 43% in Quebec.

“Quebecers have had access to pick-and-pay cable for years,” continues Canseco. “They are less likely to complain about programming variety than residents of other provinces.”

The Canadian Radio-television and Telecommunications Commission (CRTC) now allows Canadians to purchase a $25-a-month cable television plan—the so-called “skinny basic” option—with local stations and some mandatory channels. Customers can then pick and choose other channels to add to the plan. More than half of Canadians (55%) say they would be “very” or “moderately interested” in this offer, including 61% of those in the middle-income bracket.

Latest News

- Aferian to implement further cost reductions at Amino

- Paramount to exclusively represent SkyShowtime advertising sales

- Sky Sports Main Event latency reduced on Entertainment OS devices

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka