Asia Pacific OTT TV & video revenues to triple

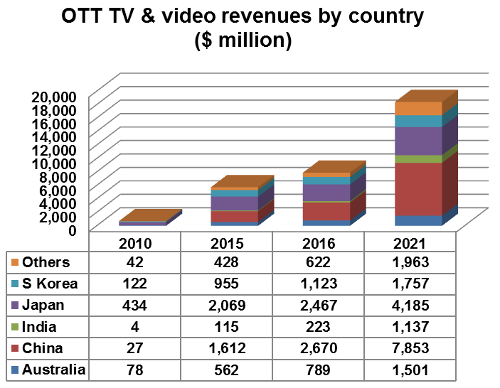

Wednesday, May 18th, 2016OTT TV and video revenues for 17 countries in the Asia Pacific region will reach $18,396 million in 2021; up from $707 million in 2010 and $5,741 million in 2015. The Asia Pacific OTT TV & Video Forecasts report estimates that China will overtake Japan in 2016 to become market leader.

Simon Murray, Principal Analyst at Digital TV Research, explained: “Smartphone users will continue to drive OTT TV & video audiences. Smartphones are a more important OTT TV reception method than fixed broadband in the Asia Pacific region – with the notable exceptions of Australia and New Zealand.”

Source: Digital TV Research

Advertising on OTT sites will remain the main revenue source, bringing in $8,745 million by 2021 – up by $6 billion from $2,609 million on 2015. China will supply $4,911 million of the 2021 total, with Japan providing a further $1,475 million.

SVOD revenues will rocket from $1,816 million in 2015 to $6,439 million in 2021. China will add $1,838 million in revenues between 2015 and 2021 – nearly sextupling its total.

Download-to-own/electronic sell-through movie and TV revenues are forecast to be $1,904 million in 2021 (with $692 million from Japan), up from $691 million in 2015. OTT TV and video rental will climb to $1,307 million in 2021.

Murray continued: “Much of the OTT activity in 2015 and 2016 has involved local players establishing themselves in their domestic markets. However, a handful of companies are taking an international approach.

“Although there is substantial demand for foreign fare, local content is necessary in each market to entice subscribers. Furthermore, international players benefit from partnerships with local players to gain from their distribution and retail infrastructure. International players must also adapt their prices to local conditions. With low levels of credit card ownership in most Asia Pacific countries, local payment systems smooth the process.

“Launched in March 2015, Netflix has achieved considerable success in Australia and New Zealand – markets most receptive to predominantly US content. However, its January 2016 launches were conducted with little local content, little local price and payment sensitivity and without local partnerships.

“This may change, of course. For instance, Netflix signed a distribution agreement with Hong Kong’s Now TV in March 2016 and has carriage deals with Singapore’s StarHub and SingTel.

“Netflix’s big splash in January 2016 prompted others to up their game. Netflix may have to adjust its policy rapidly to secure market share before its rivals become too entrenched. Major markets such as China, India, Japan and Korea are already dominated by domestic players. South East Asia provides greater opportunities for international platforms.”

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge