Latin American OTT TV and video booms

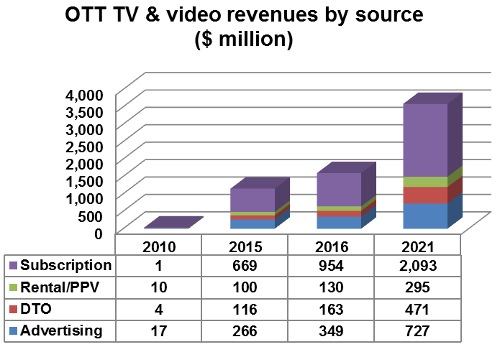

Thursday, June 2nd, 2016OTT TV and video revenues in Latin America [for 18 countries] will reach $3.59 billion in 2021; up from $32 million recorded in 2010 and more than triple the $1.15 billion in 2015, according to the Latin America OTT TV & Video Forecasts report.

Simon Murray, Principal Analyst at Digital TV Research, said: “2015 and 2016 are seminal years for Latin American OTT TV and video. Several high profile platform launches from some very well-positioned companies have already take place – with more still to come.”

He continued: “Launched across the region in September 2011, Netflix is already established. However, substantial SVOD competition is now a reality from the likes of America Movil’s Claro Video, Telefonica’s Movistar Play, HBO Go, Televisa’s Blim and Millicom’s Tigo Play.”

Source: Digital TV Research

SVOD [subscription video on demand] will remain the region’s largest OTT revenue source; contributing $2,093 million by 2021 (or 58% of the total) – up from next to nothing in 2010.

The Latin America OTT TV & Video Forecasts report estimates 31.87 million SVOD subscribers by 2021, up from only 12,000 in 2010 and 11.22 million at end-2015.

The fast take-up of SVOD will adversely affect download-to-own [DTO also known as electronic sell-through (EST)] buying patterns, albeit less so than in the rental sector.

The move towards SVOD services will stifle the pay-per-view or rental market as they provide similar consumer propositions. However, OTT TV and video rental/pay-per-view revenues will still expand rapidly, climbing from $100 million in 2015 and to $295 million in 2021.

Advertising on OTT sites (AVOD) will bring in $727 million by 2021 – up from $266 million on 2015. Free-to-air catch-up viewing is unlikely to be as prevalent as it is in other regions such as Europe.

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services