Mexico defies Latin America’s pay TV torpor

Monday, March 20th, 2017Mexico overtook Brazil in 2016 to become Latin America’s largest pay TV market, despite Brazil having twice as many TV households. Brazil has been losing subscribers since November 2014 whereas Mexico has benefited from strong adoption of prepaid satellite TV.

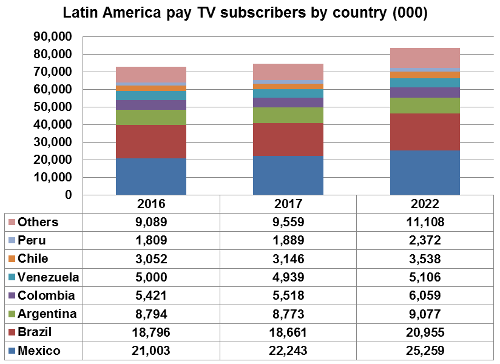

Mexico will strengthen its position, taking 30% of the region’s pay TV subs by 2022, with Brazil accounting for a quarter of the total, according to the Latin America Pay TV Forecasts report.

Source: Digital TV Research Ltd

There will be 83.47 million pay TV homes in Latin America by 2022 – up by 10.5 million on 2016’s 72.96 million. By comparison, more than 31 million pay TV subs were added between 2010 and 2016.

Pay TV revenues in Latin America [subscriptions and PPV] will grow by only 7.7% (or up by $1.4 billion) between 2016 and 2022 to $19.87 billion.

Brazil ($6.9 billion in 2022) will remain the top country by pay TV revenues by some distance, followed by Mexico ($3.2 billion) and Argentina ($2.2 billion). Brazilian subscription rates are much higher than Mexican ones (which are low largely due to the popularity of prepaid satellite TV).

Two operators dominate pay TV in Latin America. America Movil had 14.61 million pay TV subscribers (mostly under its Claro brand) by end-2016 and DirecTV/Sky had 20.49 million. These two companies accounted for 48% of the region’s pay TV subscribers by end-2016.

For more information on the Latin America Pay TV Forecasts report, please contact: Simon Murray, simon@digitaltvresearch.com, Tel: +44 20 8248 5051

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services