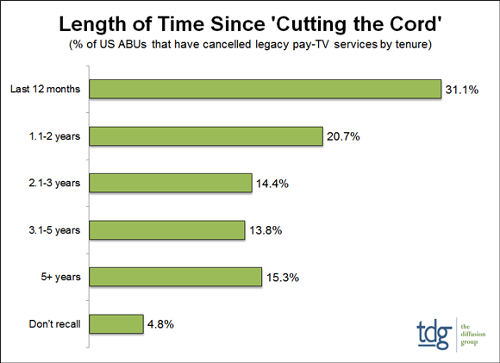

52% of U.S. cord cutters cancelled their pay TV in the last 2 years

Thursday, May 11th, 2017

TDG: The Surge of Cord Cutting in One Chart

- TDG Analysis Finds that 52% of Cord Cutters Cancelled Legacy Pay-TV Service in the Last Two Years

PLANO, TX — According to The Diffusion Group (TDG), more than half of Cord Cutters cancelled their legacy pay-TV service in the two calendar years of 2015 and 2016. Remarkably, one-third of Cord Cutters cancelled service in 2016 alone. This according to research featured in TDG’s new report, Life Without Legacy Pay-TV: A Profile of U.S. Cord Cutters and Cord Nevers.

According to Michael Greeson, Co-Founder and Principal at TDG, the uptick in cord-cutting is due to a number of factors TDG noted nearly a decade ago, including high prices and the rise of on-demand services. TDG expects the threat of cord-cutting will continue to haunt operators for some time, even as video ARPU among existing subscribers heads south.

First, the use inexpensive on-demand streaming services like Netflix and Amazon Prime has gone mainstream, triggering the majority of legacy subscribers to reassess the value of traditional TV services. “Spending $70+/month for service that provides 2X value seems odd when you can pay $10/month for a service with 1X value,” notes Greeson. “The calculus of today’s TV subscriber has been radically altered by the presence of SVOD services like Netflix.”

Second, and to make matters worse, video streaming has evolved to include a growing variety of live linear services that mirror in many ways the offerings of legacy providers but are customized to the needs of individual viewing segments. “Whether from independents (Sony Vue, YouTube TV, Hulu) or from incumbents (DirecTV Now, Dish’s Sling TV), consumers now have greater flexibility in deciding for which channels they receive and pay.”

Third, most incumbents (Comcast being the important exception) are rushing into the skinny-bundle trap; racing to the bottom in terms of price and selection to save subscribers without understanding the long-term consequences of this strategy. “True, market conditions are challenging, but many incumbents are blindly hastening the pace at which the value of robust fully-priced TV packages declines.

Greeson cites Comcast as an example of a company doing well in this new age of quantum media. “TDG observed long ago that incumbents were going to have to make a choice: either resign themselves to being a ‘dumb-pipe’ provider, or invest in using IP, change the TV experience, and become the go-to source for all things video. Comcast tuned into the later, investing in the hardware and software required to bring the power of IP to the legacy TV experience, and the company is now gaining video subscribers when others are reporting loses.”

TDG’s latest analysis, ‘Life Without Legacy Pay-TV: A Profile of U.S. Cord Cutters and Cord Nevers’, is now available for purchase. Please contact Laura Allen Phillips or call 469-287-8050.

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services