China and North America TV shipments fall sharply in Q3 2017

Monday, November 20th, 2017

China and North America TV Shipments Fall Sharply in Q3 2017, IHS Markit Says

- Much slower retail price erosion — due to increased LCD panel prices — weighs on unit volume, though worldwide TV revenues rise for first time in three years

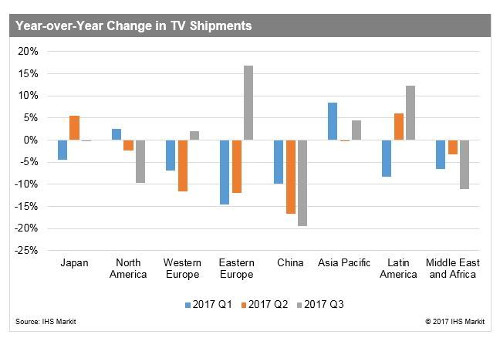

LONDON — The impact of higher LCD TV panel prices at the beginning of 2017 continued to weigh on retail demand for LCD TVs into Q3 by way of slower retail price erosion, particularly in China and North America, the two most price sensitive regions. However, demand in other regions showed signs of growth, especially in Europe and most emerging regions.

According to the latest findings from TV Sets Intelligence Service by IHS Markit, global TV shipments declined 5 percent year-over-year to 54.8 million units in Q3 2017, while revenues increased by 1 percent and average selling prices were up 6 percent due to growth in average size and 4K mix improvement.

“Demand in China has been negatively impacted by much slower retail pricing erosion for TVs, and fewer promotions as brands seek to protect profit margins.” said Paul Gagnon, executive director of TV sets research at IHS Markit. “Likewise, the high price sensitivity and minor price erosion in North America led to a 10 percent decline in year-over-year shipments in Q3 ahead of the important Black Friday holiday shopping season. We expect that the more conservative promotions on Black Friday for TVs will diminish the potential volume growth this year in the US.”

Average size growth has also slowed in recent quarters as the slower price erosion impacts consumer purchasing decisions when deciding how large a screen size to trade up to, IHS Markit analysis shows. The average size of a TV shipped in Q3 2017 increased 1.7 percent to 42.1 inches, although when combined with the much reduced price erosion, helped TV revenues increase year-over-year for the first time in three years. The growth of 4K also contributed to the positive revenue result, with 4K mix increasing to 35 percent of units and 64 percent of revenues.

On a brand basis, due to the poor demand results in China, Chinese TV brands have been aggressively pursuing more business overseas, IHS Markit says. Hisense and TCL both significantly increased market share worldwide due to strong growth outside of China. Samsung and LG Electronics are the top TV brands on a unit and revenue share basis worldwide, but TCl and Hisense have risen to numbers three and four respectively, both increasing share from a year ago to their highest TV shipment share yet. Samsung and LGE each also led on a revenue basis, while Sony grew its revenue share at number three to the highest level since 2011 on growing premium TV sales, including OLED TV.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization