Médiamétrie releases survey of SVOD market in France

Wednesday, November 22nd, 2017

SVOD Barometer – With 40% additional users in one year in France, SVOD is rapidly gaining speed

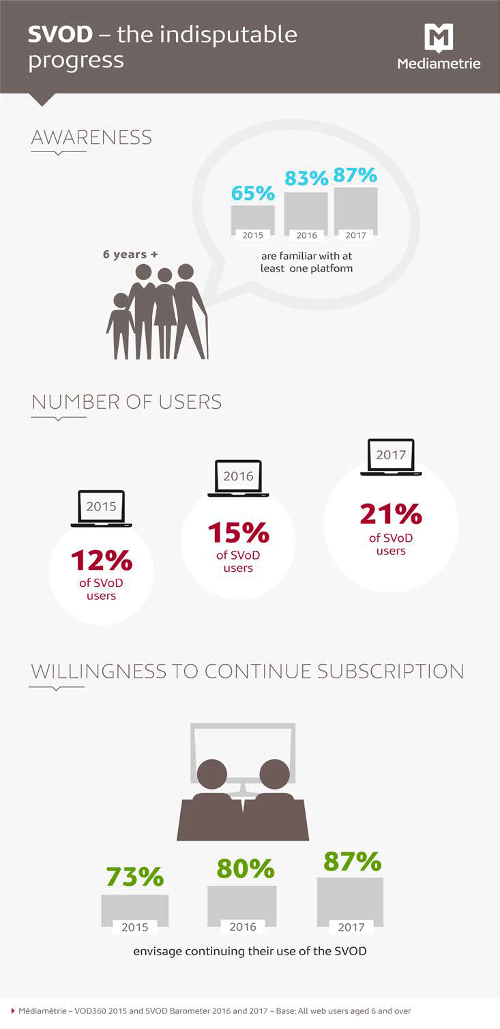

LEVALLOIS — In 2017, 1 in 5 internet users (21%) aged 6 years and over use a Subscription Video On Demand service, compared to 15% in 2016, an increase of 40%. They were a little more than 1 in 10 (12%) in 2015. This growth is essentially driven by Netflix, which is ahead of two major French players: CanalPlayand SFR Play. A recent market newcomer Amazon illustrates the momentum of SVOD. The service is often shared: 83% of SVOD subscribers share their subscription with at least one other person.

How are SVOD users using the platforms in 2017?

44% of SVOD users watch their service every day

With the launch of CanalPlay in 2011 and especially the arrival of Netflix in 2014, French audiences have become increasingly aware of SVOD services. Today, nearly 9 out of 10 people in France know of at least one SVOD platform. That represents a rise of 22 percentage points on 2015. With greater awareness comes the potential to increase the number of users. Subscription video on demand providers have seen their advertising efforts bear fruit.

The rise of SVOD is also reflected by more frequent use of the platforms: 44% of SVOD users watch their service every day, up by 2 percentage points on 2016.

And just as the fan base of SVOD is growing, its users are also becoming more loyal: back one year ago, there were 41% ex-users, compared to only 33% in 2016. Furthermore, these enthusiasts are unlikely to abandon SVOD any time soon: 87% of them intend to continue using it.

Variety of content and advanced functionalities

For many SVOD users, the most important feature of the platforms is their wealth and variety of content: 46% use SVOD to access a large number of videos. The catalogue of TV series forms the cornerstone of these platforms: this is the sort of content that SVOD users watch most, ahead of cartoons and films. As such, over 3/4 of users watch a series on their platform at least once a week, with a significant proportion watching a series every day.

SVOD users value French productions, with 2 out of 3 users making them a selection criterion. The biggest attractions to these platforms are the exclusive series and original creations that are liberated from media schedules: “Narcos” and “Stranger Things” on Netflix, “Medici: Masters of Florence” and “Riviera” on SFR Play.

Users love the advanced functionalities available when using these platforms, and top of their list are being able to switch devices and pick up watching where they had left off, and being able to access the platform on several screens. Some of the significant enhancements for 2017 are the option to create a customisedlibrary and offline viewing of content.

The success of SVOD is also due to the inherent advantages these platforms possess: absence of adverts; user peace of mind that they are watching a legal service; flexibility, with the option to end or resume a subscription at any time without cancellation periods: indeed, a sizeable proportion of SVOD users have already unsubscribed and then signed up again to the same platform or to another one. Finally, the attractive pricing of subscriptions as well as the option to share an account as a means of further reducing costs constitute factors that appeal to a lot of users.

About the SVOD Barometer

The survey was conducted online (CAWI) from 11 to 28 July 2017 among 4,020 web users aged 6 years and over. The SVOD Barometer provides the framing data for the subscription video on-demand service market in France and explains how these services are used:

- Measure awareness and use of SVOD services

- Determine the profile of SVOD service users

- Measure motivations and obstacles to using SVOD services

- Get to know the context and process to sign up

- Study the consumption of series

- Measure usage of the available functionalities

- Determine the satisfaction with platforms overall, and against a set of criteria

- Analyse each of these elements according to the platform used (Netflix, CanalPlay and SFR Play)

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge