One in five U.S. broadband households use a digital antenna to access live TV

Thursday, March 15th, 2018

New consumer research finds use of antennas steadily increasing

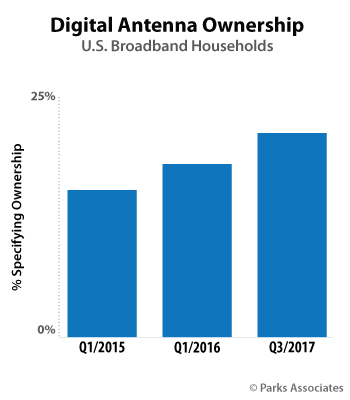

New consumer research from Parks Associates shows the percentage of U.S. broadband households that use digital antennas in their home has steadily increased to reach 20% near the end of 2017, up from 16% in early 2015. 360 View: Access and Entertainment Services in U.S. Broadband Households reveals this increase coincides with a steady decline in pay-TV subscriptions and an increase in OTT video subscriptions.

“Increasingly, consumers are cobbling together their own bundles of content sources. Digital antennas are experiencing a resurgence as consumers consider over-the-air TV and OTT video services as alternatives to pay TV,” said Brett Sappington, Senior Director of Research, Parks Associates. “The percentage of ‘Never’ households (households that have never subscribed to pay-TV services) has held steady, and the percentage of households actually cutting the cord has increased between 2015 and 2017. Antennas are an affordable source for local channels to these households.”

Parks Associates notes that high cost and low price/value perception dominate reasons for service cancellation and bundle shaving. More than 50% of the households that have switched, shaved, or cut the cord cite the service is “not worth the cost.”

“Pay-TV providers need to address this value perception gap and re-establish their role as the consumers’ source for interesting content,” Sappington said. “Opportunities are available. Only 46% of pay-TV subscribers are aware that they can access video-on-demand content from their operator, including free programming. Many indicate that they want to purchase online video services through their pay-TV provider and to access the service through their channel guide.”

360 View: Access and Entertainment Services in U.S. Broadband Households explores the environment, consumer demand, use, and perception of pay-TV and broadband services among U.S. broadband households. It also analyzes the impact of over-the-top (OTT) services as well as cord-cutting and cord-shaving on pay-TV services. Additional research shows:

- 63% of subscribers who cannot currently restart programs from the beginning find that feature to be appealing

- 17% of consumers who cancel their pay-TV service would have stayed with their provider if there were no monthly fees for their set-top boxes

- Average fees for standalone broadband have increased nearly 25% since 2010

- 20% of Wi-Fi households experience problems with coverage in their home

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services