America's appetite for streaming video continues to grow

Tuesday, March 20th, 2018

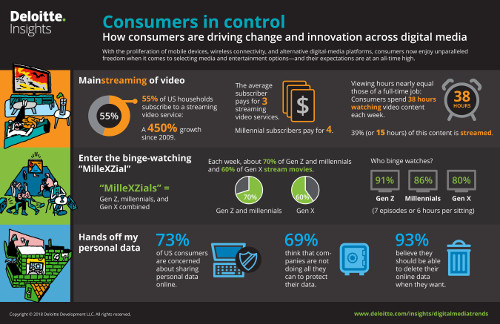

Deloitte: Meet the MilleXZials: Generational Lines Blur as Media Consumption for Gen X, Millennials and Gen Z Converge; Video Streaming Subscriptions Hit 55 Percent, Up 450 Percent Since 2009

- Streaming Video on Demand hits the mainstream

- Pay TV subscriptions decline as consumers rethink its value

- Watching video is a 38 hour a week “job”

NEW YORK — American consumers’ appetite for streaming video continues to grow, and they have no qualms shelling out cash for original content, according to Deloitte’s 12th edition of the “Digital Media Trends Survey” (formerly the “Digital Democracy” Survey). The report found that 55 percent of U.S. households now subscribe to at least one video streaming service, a 450 percent increase since 2009.

The survey found, on average, Americans watch 38 hours per week of video content (39 percent of which is streamed), nearly the equivalent of a full-time job. With over 200 streaming video on demand (SVOD) options in the U.S., the average streaming video subscriber is paying for three services resulting in U.S. consumers collectively spending $2.1 billion per month on SVOD services. High-quality original content appears to be driving an increase in streaming with nearly half (48 percent) of all U.S. consumers streaming television content every day or weekly, up 11 percent year-over-year.

Conversely, the report found pay TV subscriptions declined for the first time in recent years with 63 percent of households still subscribing to a traditional Pay TV service, down from 75 percent. Pay TV’s decline is especially pronounced among Generation Z (ages 14-20), Millennials (ages 21-34) and Generation X (ages 35-51).

“Consumers now enjoy unparalleled freedom in selecting media and entertainment options and their expectations are at an all-time high,” said Kevin Westcott, vice chairman and U.S. media and entertainment leader, Deloitte LLP. “The rapid growth of streaming services and high quality original content has created a significant opportunity to monetize the on-demand environment in 2018.”

Pay TV penetration declines

With video streaming enabling unprecedented choice and access to content, consumers perceive a widening gap between their expectations and what pay TV companies deliver, according to the report:

- Nearly half (46 percent) of all pay TV subscribers said they are dissatisfied with their service and 70 percent of consumers feel they get too little value for their money.

- Among respondents who said they no longer have a pay TV subscription, 27 percent reported they cancelled their service within the last year.

- Furthermore, 22 percent of millennials say they have never subscribed to a pay TV service.

- Twenty-two percent of all consumers without pay TV say they don’t watch enough TV to justify the expense and another 19 percent say they simply cannot afford it.

- Fifty-six percent of current pay TV subscribers say they keep their pay TV because it’s bundled with their home internet access.

“As video streaming and demand for original content continue to grow, traditional and premium cable broadcasters will continue to rethink their business models,” continued Westcott. “Media companies are increasingly going direct-to-consumer with their own digital streaming services and snackable content. Ultimately, one challenge we see is that consumers may be reluctant to pay for exclusive content on top of their other paid subscription services and this may lead to some form of re-aggregation as limits on consumer spending could potentially hinder the growth of content platforms.”

The emergence of MilleXZials: 50 is the new 20

This year’s data indicates a convergence of media behavior across three key demographics. Gen X emerged as cutting-edge adopters of digital media embracing the digital media behaviors already adopted by Gen Z and millennials. Deloitte calls this combined demographic group “The MilleXZials.”

- Seventy percent of Gen Z households had a streaming subscription, closely followed by millennials at 68 percent and Gen X at 64 percent, respectively.

- About 70 percent of Gen Z and millennials stream movies compared with 60 percent of Gen X on a weekly basis.

- Binge-watching behavior also witnessed a convergence among MilleXZials:

- Ninety-one percent of Gen Z, 86 percent of millennials and 80 percent of Gen X binge-watch TV shows.

- More than 40 percent of millennials binge watch weekly, and they watch an average of seven episodes and six hours in a single setting.

- Ninety-six percent of MilleXZials multitask while watching TV.

“Millennials were the first generation to embrace streaming media and watching video content on smartphones,” said Dr. Jeff Loucks, the executive director, Deloitte Center for Technology, Media and Telecommunications, Deloitte LLP. “Some hoped that as millennials got older, they would settle down and watch pay TV. Instead, their Gen X parents are acting more like millennials, using streaming services, watching TV shows, movies and sports on smartphones and binge watching.”

Consumers want more control over their personal data

Consumers are increasingly concerned about putting their personal data online. The study found 69 percent of consumers believe that companies are not doing everything they can to protect their personal data. However, 73 percent of all consumers said they would be more comfortable sharing their data if they had some visibility and control and 93 percent of U.S. consumers believe they should be able to delete their online data when they want.

The 12th edition of Deloitte’s Digital Media Trends survey provides insight into how five generations of U.S. consumers interact with media, products and services, mobile technologies and the internet. This year’s U.S. data was collected in November 2017 and employed an online methodology among 2,088 consumers.

Latest News

- TargetVideo integrates AI for video content categorization

- Meta opens Meta Quest OS to third-party hardware makers

- Aferian to implement further cost reductions at Amino

- Paramount to exclusively represent SkyShowtime advertising sales

- Sky Sports Main Event latency reduced on Entertainment OS devices

- Netflix posts first quarter 2024 results and outlook