German VOD revenues growing faster than ever

Monday, June 11th, 2018Revenues in the German Video-on-Demand market are growing faster than ever before

- Goldmedia publishes new market forecasts on the Pay Video-on-Demand market (SVOD, TVOD, EST) in Germany from 2018 to 2023

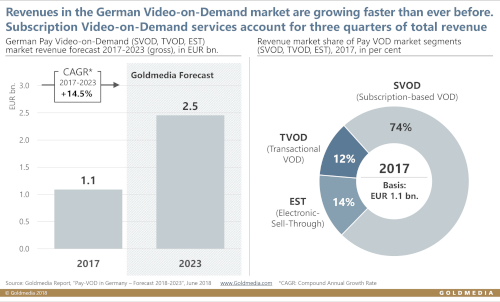

- Total revenues (gross) are anticipated to more than double from 1.1 billion euros (2017) to 2.5 billion euros by 2023

- Subscription Video-on-Demand (SVOD) services account for three quarters of total revenue

BERLIN – Germany — Video-on-Demand (VOD) is turning into a mass market. At the end of 2017, 18 per cent of all German households were subscribing to at least one paid-for Video-on-Demand service. The market appears to be on an unabated growth trajectory and the boom in the Pay VOD market (SVOD, TVOD, EST) is seeing revenues soar through the roof. Total revenues (gross) at the end of 2017 amounted to 1.1 billion euros and are anticipated to more than double within only five years, climbing to 2.5 billion euros by 2023.

These figures have recently been published in the report ‘Pay VOD in Germany – 2018-2023 Forecast’ by the consulting and research group Goldmedia (www.Goldmedia.com). This industry report includes an up-to-date market analysis and forecasts on paid-for Video-on-Demand services in Germany up to 2023.

Currently 30 providers in the German market with new players in the starting blocks

Amazon Prime Video Service and Netflix continue to lead the pack in the German VOD market. Netflix primarily focuses on SVOD (subscription video on demand), whilst Amazon’s video offering is integrated into its Prime service where video titles can be either rented or purchased (TVOD = transactional VOD and EST = electronic sell-through).

Other important players in the German Pay VOD market are Sky (front runner in the classic pay-TV market), Maxdome (subsidiary of the ProSiebenSat.1 Group), Apple’s iTunes and Google’s Playstore. Specialist sports streaming services such as DAZN and Eurosport are also seeing an increase in users.

The market is not likely to run out of steam in the near future. The forecast suggests that it is more likely that the competitive landscape will soon start shifting in this rapidly growing market. Global service providers are already in the starting blocks with their new VOD platforms.

Attractive content and improved availability are important drivers

Subscription-based VOD (SVOD) services account for by far the highest share of turnover in the German paid-for VOD market with a share of 74 per cent (2017). Goldmedia forecasts that this segment is capable of achieving an 80 per cent share by 2023. The leading players in the SVOD market are focusing heavily on producing their own original content. However, licensed titles that are streamed via TVOD and EST are also popular among users, especially new feature films which are available to view on demand just a few months after they have been released in cinemas.

In addition to attractive content, one of the most important market drivers is the way in which the services have become more convenient to access at any time of the day via smart TVs or special streaming devices such as the Amazon Fire TV Stick. The growing number of households with high-speed broadband connections is also boosting VOD’s technical reach. The rural market is continuing to play catch-up and it is anticipated that huge potential will be unlocked in these areas in particular. Goldmedia predicts that every other household with a broadband connection will subscribe to a VOD service by 2019.

Wrangling over exclusive rights is driving spiralling prices. Sport is becoming increasingly important

The wide range of content in the Video-on-Demand market is continually growing. Content that serves niche markets such as children’s programming and independent films has been available for a while now. The sports segment is continuing to gain further ground which is evident in the way that VOD service providers are vying to gain exclusive rights to stream sports events. For example, the first match of the 2017/2018 Bundesliga football season could only be viewed on the internet (via Eurosport Player).

Source: Goldmedia study ‘Pay VOD in Germany – 2018-2023 Forecast’

All the information included in this press release is taken from the Goldmedia study ‘Pay VOD in Germany – 2018-2023 Forecast’ (June 2018). The study examines in detail the market for paid-for Video-on-Demand services in Germany (SVOD, TVOD, EST) and includes analyses of service providers, business models, potential revenue and potential usage figures up to 2023. Turnover figures are based on VOD usage which have been measured as part of the Goldmedia VOD ratings. This has been used to calculate end user prices (gross), taking into account discounts or free months. All revenue from fees charged for the Amazon Prime service has been included, however, only for customers who actually use the Prime Video service.

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services