IPTV drives Asia’s pay TV growth

Monday, March 11th, 2019The Asia Pacific pay TV sector is vibrant, with both subscribers (up by 68 million) and revenues (up by $2.35 billion) forecast to rise over the next five years. However, these forecasts are lower than the previous Asia Pacific Pay TV Forecasts report, mainly due to many cable subs in China converting to OTT.

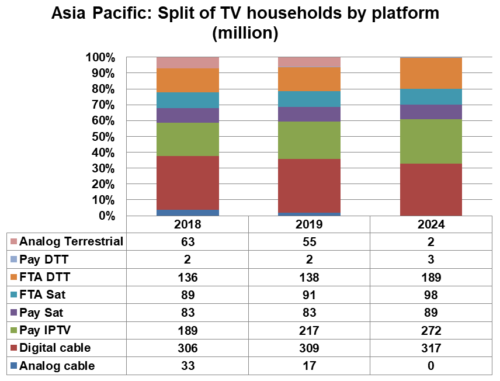

Source: Digital TV Research Ltd

Simon Murray, Principal Analyst at Digital TV Research, said: “IPTV is the biggest pay TV winner – adding 83 million subscribers between 2018 and 2024 to take its total to 272 million. Much of this growth will happen in China [up by 40 million] as cable subs convert to OTT or IPTV and in India [up by 28 million].”

Reliance is poised to shake up India’s staid fixed broadband sector with its Jio GigaFiber operation as it has done in the mobile sector. Indonesia, the region’s third most populous country, will also enjoy substantial IPTV growth.

Cable will suffer. Digital cable subscriptions will be flat overall. China will lose 25 million cable subs between 2018 and 2024, although India will add 13 million. Analog cable subscriptions will fall by 33 million.

The pay satellite TV sector is mature, with only 6 million subscribers to be added between 2018 and 2024 to take the total to 89 million. Due to mainly to consolidation, India will lose nearly 3 million subscribers.

China and India together will account for 80% of the region’s 681 million pay TV subscribers by 2024. About 68 million pay TV subs will be added between 2018 and 2024, with China and India together supplying two-thirds of the extra subs – so they will grow at a slower rate than the rest of the region.

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services