China's DVD Industry Faces Role Changes

Friday, May 23rd, 2008BEIJING — CCID Consulting, China’s leading research, consulting and IT outsourcing service provider, and the first Chinese consulting firm listed in Hong Kong (Hong Kong Stock Exchange: HK08235), recently released its article on China’s DVD industrial role changes.

February 19, 2008 has historical significance to the global DVD industry. After years of competition between Blu-ray DVD and HD DVD, with Toshiba giving up its support to HD DVD, HD DVD has lost its market. Will Blu-ray DVD standard benefit from the absolute advantage? As a big manufacturing nation, China is only a stander-by in this competition among foreign giants. Facing fierce competition, patent fee’s compression, industrial profits’ great slide, China’s DVD industry faces the challenge of four roles changes.

The First Role: Transforming “Made in China” to “Innovate in China”

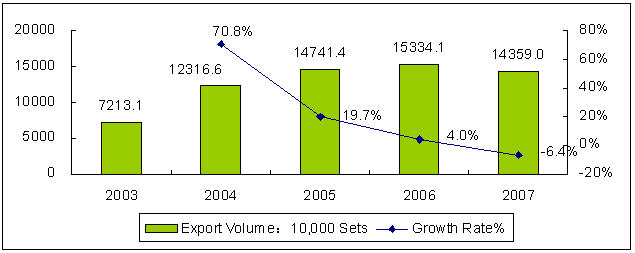

China’s DVD manufacturing position has further strengthened in 2007. CCID Consulting’s data shows that 94% of global DVD players are made in China. DVD content providers centralize in U.S and Japan; chip providers centralize in U.S., Japan and China Taiwan; disk sheets’ and whole machines’ manufacturings centralize in China mainland. The export volume of DVD players shrinked in 2007, with 143 million sets, down 6.4% over 2006, which the export volume was 153 million sets. High patent fee becomes the major factor of restricting export. The technical bottleneck is the urgent issue to be solved in China’s DVD industry. At present, competitive pattern is not only the product competition, but also technical and service competitions. At such a critical point, China’s DVD industry needs to establish an independent core technical industrial chain and devote to new products’ development. Only by breakthoughs in core technology and innovations in technical standard, can China enhanced itself from a producer to a creator.

Figure 1: Export Volume of China’s DVD Player, 2003-2007

Source: CCID Consulting, Jan. 2008

The Second Role: Transforming Specialization to Diversification

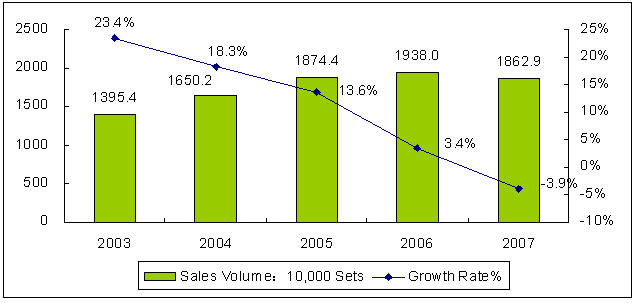

sales volume of DVD players in China was a slide in 2007. CCID Consulting’s data shows that the growth of sales volume of China’s DVD player slowed down from 2003 to 2006. In 2007, the sales volume was 18.6 million sets, down 3.9% over 2006. This shows that after many years of rapid development, China’s SD DVD market’s saturation further increased, valid demands gradually decrease. Meanwhile, unfair competition result in the vicious competition in pricing of DVD players. Pressure in profits have forced some enterprises to give up DVD player manufacturing. In 2006, the number of enterprises engage in DVD manufacturing and trades was 830, but in 2007, the number went down to 460. Brand concentration further improves. The enterprises originally in the DVD player field is transferring their focus. BBK, Wanlida, Shinco and Amoi now pay more attention to LCD TV and mobile phone fields. China’s DVD manufacturers transform from specialization to diversification.

Figure 2: Size & Growth of China’s DVD Player Sales Volume, 2003-2007

Source: CCID Consulting, Jan. 2008

The Third Role: Transforming SD to HD

The demand for China’s SD DVD player market have a slow growth in 2007. Competitors centralize, SD DVD players have become a popular product and industrial profit shrinks. Industrial period has entered a ripe latter stage. New substitutes are cultivating. The market development law cannot be changed.

The close relation between DVD players and TVs drives the transformation from SD to HD. Flat panel HDTV becomes a gradual trend instead of CRT TV. The sales volume of China’s flat panel TV reaches 7.888 million sets. The sales volume of China’s HDTV accounts for 33.8% of the total color TV market. Consumers’ demands for HD increase year by year. Therefore, China’s DVD industry will welcome in HD era.

The Fourth Role: Replace and Coexist

Sony Blu-ray HD DVD comes into market in China’s 60 cities in 2008, but expensive price and disks’ shortage are still the bottleneck of restricting Blu-ray DVD’s development. China’s independent developing red-ray HD DVD has great progress on the aspects of resolution and capacity; compared with blue- ray, it has price advantage, but it needs content providers’ support. Whether China’s HD red-ray could build up industrial chain which includes optical head, chip, whole machine, disk and content is the biggest test. With the market’s development, red-ray and Blu-ray are the two major camps in China’s HD DVD market.

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services