Telcos to dominate Western European pay TV

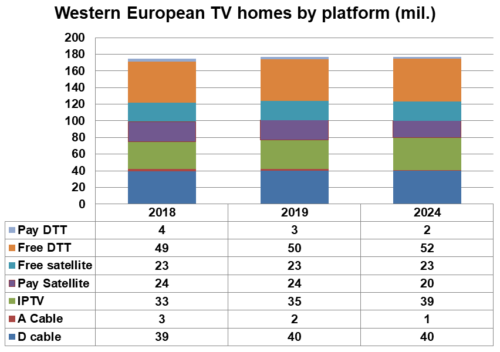

Thursday, May 23rd, 2019Reflecting the rising importance of the telcos, IPTV is gaining subscribers in Western Europe at the expense of the other pay TV platforms. IPTV overtook satellite TV in 2015 and will be approaching cable by 2024. IPTV will add 5.5 million subscribers between 2018 and 2024.

Simon Murray, Principal Analyst at Digital TV Research, said: “IPTV operations are owned by telcos. Some telcos also have assets on other platforms. If all of the current proposed deals receive regulatory approval, then telcos will have 18.61 million non-IPTV subscribers by 2024. Adding the 38.72 million IPTV subscribers, telcos will control 56% of Western Europe’s pay TV subscribers by 2024.”

Source: Digital TV Research

Murray continued: “This marks a sea change for Western Europe’s pay TV sector. Pay TV is not the priority for telcos – broadband and mobile provision are at the forefront.”

Western Europe will have 101.59 million pay TV subscribers by 2024. Germany will contribute a quarter of the total, followed by the UK (15%) and France (14%).

Half of the 18 countries covered in the Western Europe Pay TV Forecasts report will lose pay TV subscribers between 2018 and 2024. Italy will decline the most (down by 728,000 subs) from the 1,229,000 overall losses, followed by the UK (down by 621,000).

Cable TV will have 40.28 million subs by 2024 (down by 7 million on 2010). Digital cable TV will gain 1 million subscribers between 2018 and 2024, but analog cable will shed more than 2 million.

Pay satellite TV will lose 4 million subscribers between 2018 and 2024 – usually as homes convert to platforms with bundles – to reach 20.33 million.

Despite the number of Western European pay TV subscribers falling by only 1.2% between 2018 and 2024, revenues will decline by 13.1%. Pay TV revenues will dip by $3.84 billion between 2018 and 2024 to $25.44 billion.

The UK will lose $1 billion over this period, but will remain the most lucrative pay TV market. Italy will fall by $823 million – or 24% – due mainly to Mediaset’s conversion from pay DTT to online.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization