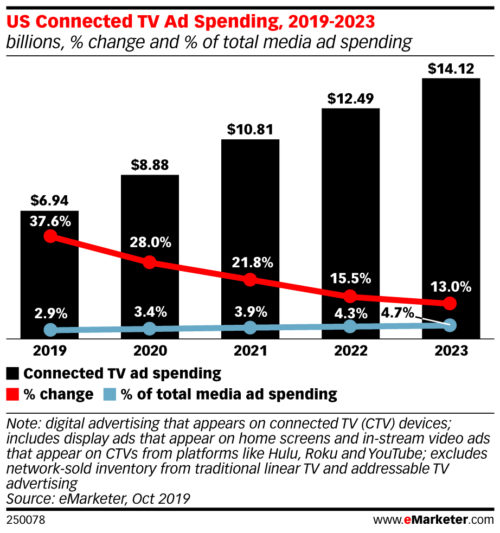

U.S. Connected TV ad spending will grow nearly 40% in 2019

Tuesday, November 5th, 2019CTV advertising will surpass $10 billion by 2021

NEW YORK, NY — Connected TV advertising* is a small, but rapidly growing portion of digital advertising, and it’s competing directly with traditional TV advertising. In our inaugural forecast on CTV spend in the US, we expect the channel to grow 37.6% this year to reach $6.94 billion. By 2021, it will surpass $10 billion.

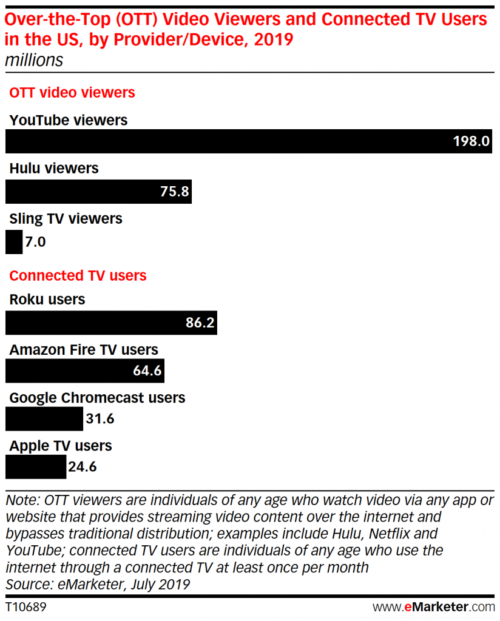

“When looking at ad revenues, YouTube, Hulu and Roku are the leaders in this market,” eMarketer forecasting analyst Eric Haggstrom said. “Users of these platforms are likely either cord-cutters or cord-shavers. That means some TV ad buyers are willing to pay a premium to reach users who are difficult to reach via traditional TV ads. These platforms are also bulking up their targeting, programmatic and attribution capabilities in order to attract buyers from the digital world.”

Despite the opportunities to advertise on CTV platforms, there are factors holding back growth.

“Measurement is a huge problem that is holding back linear TV advertisers from advertising on CTV,” Haggstrom said. “There is no single, commonly accepted measurement across platforms like there is in TV. Also, CTV targeting, attribution and programmatic capabilities are significantly behind those of other leading digital ad platforms.”

Additionally, the huge influx of new over-the-top (OTT) services entering the market in Q4 2019 through 2020 will affect the entire industry. Many are not ad-supported, like Disney+, Apple TV+ and HBO Max. NBCU’s Peacock service is the notable exception.

“It is far from guaranteed that any of the new services will be successful in terms of gaining large audiences,” Haggstrom said. “But low-priced, ad-free services from Apple and Disney will likely make platforms that do have ads less attractive to consumers than they currently are.”

CTV usage in the US will grow 5.3% to reach 195.1 million viewers (all ages) by the end of this year, surpassing 200 million in 2020. Roku devices lead the category with 44.2% of viewers, followed by Amazon Fire TV, Google Chromecast and Apple TV. (Note: There is overlap, as some viewers use more than one device.)

* digital advertising that appears on connected TV (CTV) devices. Examples include display ads that appear on home screens and in-stream video ads that appear on CTVs from platforms like Hulu, Roku and YouTube; excludes network-sold inventory from traditional linear TV and addressable TV advertising.

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

Latest News

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services

- Vantiva has shipped 22 million Android TV set-top boxes

- Newsmax launches subscription-based app with 24i

- Slovak Telekom and T-Mobile CZ upgrade video streaming with 24i

- CTV/OTT expected to be fastest growing media channel in U.S. in 2024