Swedish streaming market saturating

Tuesday, February 11th, 2020Swedish streaming market saturating – will new services spur growth?

Looking at year-end 2019, Mediavision concludes that 54% of all households in Sweden now subscribe to at least one online video streaming service. The relatively limited growth over the past year, may be a sign of the market maturing. However, the number of subscriptions per household, also called stacking, is increasing steadily. Several new streaming services are set for launch 2020. This could very well push the market into a new wave of growth.

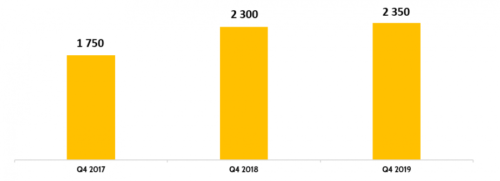

Following several years of strong growth in uptake of SVOD subscriptions in Sweden, Mediavision notices a slowdown in the 2019 full-year development. For example, market leader Netflix´s customer base has remained stable at 1.6 million subscribers during the year. Nor did the launch of Apple TV+ increase the number of streaming households considerably. This implies that the video streaming market is approaching maturity. However, growth is still significant in terms of “stacking”, i e streaming-households acquiring additional SVOD subscriptions.

Several new services are entering the market. For example, Swedish Tele2 recently launched Com Hem Play+ and this summer Disney+ is expected to reach the Nordics. Disney’s latest quarterly report revealed that its subscription growth so far has exceeded expectations. By offering titles such as Avengers, Mandalorian and Star Wars, at a lower monthly cost than most of its competitors, Disney+ may contribute to a new push in household penetration.

For the actors in the market, global as well as local, continued growth of the customer base is essential. Content costs are reaching new record-levels, also implying that customer growth is increasingly important moving into the new decade.

“The streaming market in Sweden has, after several years of strong growth, slowed down significantly during 2019. For the actors, global as well as local, this means increased competition. If household penetration doesn’t pick up, the players must rely on stacking in order to grow. But since we know that the starting field this year is strong, it is still too early to make any prediction about the outcome of 2020” says Marie Nilsson, CEO of Mediavision.

Latest News

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization

- Meta opens Quest OS to third-party hardware makers

- Aferian to implement further cost reductions at Amino

- Paramount to exclusively represent SkyShowtime advertising sales