First Total TV findings released by Virtual Australia (VOZ)

Thursday, February 27th, 2020

Initial VOZ insights confirm Total TV view essential to planning and evaluating broadcast content performance

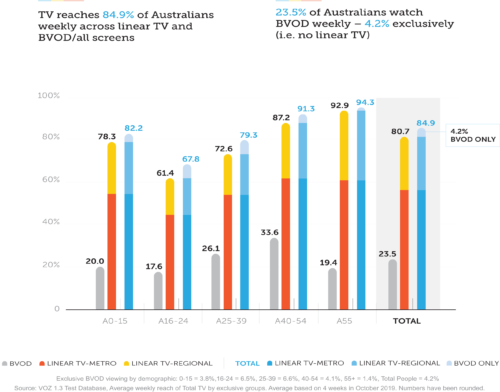

- 85% of Australians watch broadcast TV weekly and nearly a quarter watch BVOD

- Over a month almost half the linear TV audience has also watched BVOD

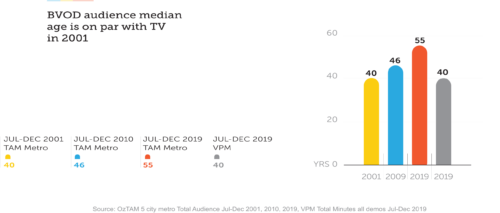

- Median age of BVOD audience is 15 years younger than linear TV

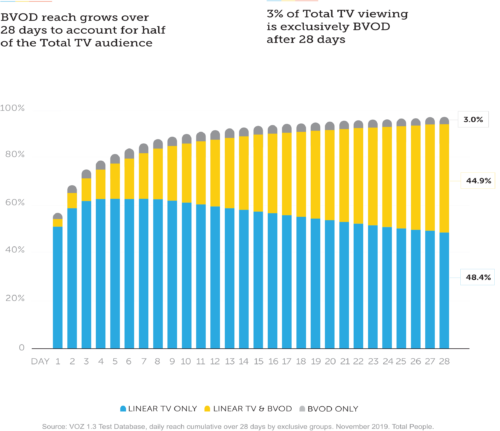

- BVOD delivers approx. 4% incremental reach to linear TV weekly, 3% monthly

- Regional Australia accounts for approx. 30% of Total TV content viewed

Initial insights from Virtual Australia (‘VOZ’) – the foundation of Australia’s new Total TV reporting standard – confirm that to fully evaluate the performance of television content, it’s essential to have a national view of how that content is consumed over time and across devices.

In the first stage of a phased rollout, OzTAM, Regional TAM and Nielsen today release top line findings from the new VOZ integrated Total TV database, which brings together broadcast* viewing on TV sets (‘linear’) and connected devices (‘BVOD’) to provide all-screen, cross-platform planning and reporting for Australia’s television industry.

OzTAM CEO Doug Peiffer said: “We’ve long observed that as Australians have embraced the mind-boggling array of content, screen and platform choice now available that the reach of broadcast TV goes well beyond the TV set itself. “It’s been unclear though to what extent such ‘any time, any place, any screen’ viewing impacts the Total TV picture, until now.”

“Early VOZ data shows that BVOD brings a significant weekly reach gain across younger demographics.”

VOZ answers key questions for Australia’s television industry, including:

- Question: What proportion of Total TV content is viewed on TV sets and connected devices, and how much incremental reach does BVOD deliver to broadcast viewing?

Answer: Each week, 85% of Australians watch broadcast TV and almost a quarter (6 million people) watch BVOD. 4.2% of viewers watch BVOD exclusively, meaning they watched no linear TV during the period.

- Question: How do viewers move between the TV and other screens over time, and what does longer-tail BVOD viewing add to Total TV consumption?

Answer: Over a four-week period, nearly half of linear TV viewers have also watched broadcast content on other screens. 3% of Total TV viewing is exclusively BVOD, meaning those viewers watched no linear TV during the 28- day time span.

- Question: How much younger is the BVOD audience compared to that for linear TV? To what extent are younger viewers gravitating towards BVOD?

Answer: The median age of BVOD viewers is 40, which is 15 years younger than that for linear TV. In fact, the median age of the BVOD audience is on par with that of TV in 2001.

Mr Peiffer remarked: “VOZ data crystallises what we have long known intuitively was the case: reaching a target audience involves considering how all screens are used over time, and planning accordingly.”

Although VOZ would continue to evolve, and is set to show its full potential in the media buying ecosystem once deployed within the broadcasters’ planned shared demand-side platform, Mr Peiffer said the industry could start using VOZ immediately.

“VOZ insights can be used now in planning, delivering a much clearer picture of viewing on all screen types, inside and outside homes, around Australia and over time,” Mr Peiffer said.

“VOZ is here to reveal the Total TV picture, providing an objective, transparent and standard metric to evaluate TV performance across all screens and platforms, and reinforcing that television remains the most effective way to connect to audiences at scale.”

This week’s release of initial VOZ insights is the beginning of a phased rollout. Daily VOZ data will be available to subscribers from late April, and VOZ has been built to allow the industry to agree a common set of advanced targets (audience segments) to support planning and post-analysis beyond standard age/sex demographics in future. OzTAM is facilitating those discussions. VOZ has also been designed to integrate within the broadcasters’ planned shared demand-side platform.

* Broadcast content comprises viewing of metropolitan and regional free-to-air and subscription broadcasters’ TV (TAM) and online (BVOD) services. This includes viewing through the television set (both live and played back within 28 days by 20,000+ individuals in OzTAM and Regional TAM panel homes) and on 14m connected devices such as smart TVs, desktop/laptop computers, tablets and smartphones. Participating BVOD broadcasters: ABC, Seven Network, Nine Network, Network 10, SBS and Foxtel.

Latest News

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge

- Virgin Media partners with PubMatic to scale FAST advertising

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services