Chinese streaming platforms taking over SE Asian markets

Tuesday, August 25th, 2020

Chinese streaming platforms are taking over Southeast Asian markets

This summer, Baidu’s streaming service iQiyi announced its plan to expand towards new markets in Asia-Pacific. The platform was launched in the second half of 2019 in Vietnam and Malaysia and is eyeing other strategic markets in Southeast Asia. Meanwhile, in June, Tencent acquired the Malaysian service iFlix. The latter has been struggling to generate profit and accumulated losses over the past few years, opening an opportunity for the Chinese media group to acquire its significant content library. As of 2020, iFlix is operating in 13 countries across Asia, a market which Tencent will take over by both maintaining the brand’s operation and expanding its own service WeTV on those territories. For now Tencent’s two streaming services are operated independently but are supposed to merge over time. WeTV was launched during summer 2019 in Indonesia, Thailand and Vietnam.

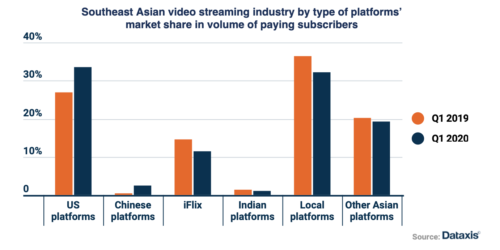

The Southeast Asian streaming industry has seen considerable changes this last year as Chinese streaming services have been taking over a large part of viewers and investing in local content significantly. Chinese media groups are capitalizing on the potential of a huge and still untapped market. Only 3.6% of Southeast Asian households were paying a subscription for legal streaming services as of end 2019. At Q1 2020, US based platforms had the largest share of paying subscribers, which is mostly explained by a sharp increase of Netflix subscribers during the worldwide lockdown measures and the introduction of cheaper mobile plans in Southeast Asian strategic markets at Q4 2019 and Q1 2020.

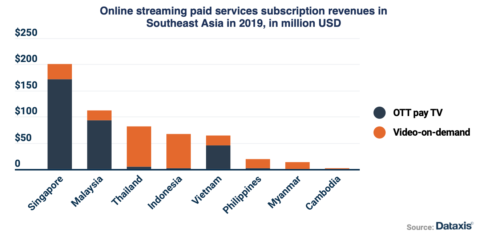

In 2019, legal online streaming services generated $560 million in Southeast Asia out of paying subscribers alone. The biggest markets were Singapore and Malaysia, where OTT pay TV services are gathering the vast majority of paying users. But SVOD is not leading the development of video services in the region. The video streaming markets in Southeast Asia are clearly demonstrating a viewers’ preference for AVOD (advertising video-on-demand) platforms.

Most of those countries don’t have a very high pay TV penetration (except Malaysia), and piracy is still widespread despite authorities and telcos’ efforts to tackle it. That’s why most media consumers in Southeast Asia are not used to paying to access video content. In the region, platforms offering free access to their content reach much more viewers than SVOD pure players like Netflix.

But the advertising based financial model has proved hard to turn into sustainable products. Some actors that have been on the market for several years are still struggling to generate profit, as Hooq’s shut down and iFlix’ acquisition showed us last quarter. This is due to a highly competitive environment where OTT platforms have to invest in new content constantly, despite advertising revenues remaining rather low in the region. Chinese OTT might be the only actors who can afford to keep AVOD as their main model to reach a large number of viewers while still investing in valuable content without making sufficient operating margins in the next few years.

Local platforms, if they survive the current downturn of advertising markets following COVID-19’s impacts on the media economy, will have to face strong competition especially from Chinese OTT. Observers notice that iQiyi might be merging with Tencent’s WeTV soon to create the world’s biggest streaming service. Both brands are already gathering a growing audience in Southeast Asian markets and the large amount of regional content in their libraries is also more likely to attract customers which were not considering paying subscriptions for US platforms. Since the vast majority of local players are based on an AVOD or a freemium model, their survival will most likely rely on their ability to generate revenues by introducing and developing paid offers.

Latest News

- Tata Motors selects HARMAN Automotive's in-vehicle app store

- Media Distillery to power Swisscom ad-free replay product

- MagentaTV strengthens addressable TV business with Equativ

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization