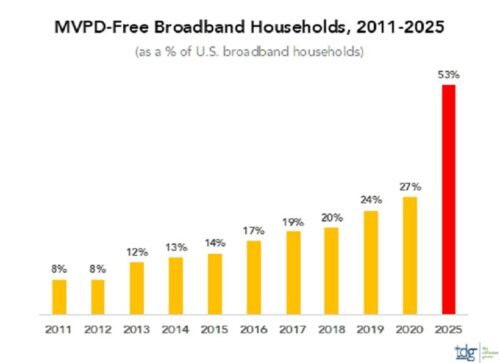

58 million U.S. broadband households to be MVPD-free by 2025

Wednesday, October 14th, 2020

TDG: 58 Million U.S. Broadband Households Will Live MVPD-Free By 2025

- The research consultancy forecasts five-year losses to increase four-fold between 2020-2025 versus 2015-2019

LOS ANGELES — According to The Diffusion Group—a division of Screen Engine/ASI—by 2025 more than half of U.S. broadband households will live without a MVPD service. During this time, pay-TV services will lose 36% of their 2020 subscriber base, up roughly four-fold from the prior 5-year period (-9.5%).

TDG’s new forecasts reflect two recent insights:

(1) The rate of decline in legacy MVPD subscriptions exceeded TDG 2017 forecasts for 2020, and

(2) New consumer research reveals cord-cutting proclivities are at an all-time high.

“For the last decade, TDG accurately anticipated the rate of legacy’s decline and the sluggish growth of vMVPDs,” said Michael Greeson, President and Principal Analyst at TDG. “However, our 2017 forecasts underestimated the growth in cord-cutting and overestimated the uptake of vMVPDs. Beginning in 2007, our 5-year forecasts have been eerily accurate, but it was obvious that 2017 forecasts needed to be tweaked. We were within 5%, but at two years out versus five.”

For perspective, consider the following.

- In 2015, 16% of broadband households were to some degree likely to cancel their pay-TV service, 7% moderately likely or definitely doing so.

- Today, 25% of broadband households are similarly inclined (up 56% from 2015), with 13% moderately likely or definitely doing so (up 86% from 2015).

- Thus, 14-million U.S. broadband households are more than slightly likely to ditch pay-TV altogether, nearly half of which will do so in 2020.

Given these trends, TDG expects that 2025 will see less than half of U.S. broadband households subscribing to an MVPD service. “These video nomads have a very different concept of home video than their predecessors—one that costs less and includes a more self-determined channel lineup.’ As TDG first predicted in 2006, this new viewing paradigm is largely defined by an evolving set of paid, transactional, and free video streaming services—in one-third of cases supplemented by OTA—configured not by a pay-TV operator but by household decision-makers.

With MVPD-free viewers set to comprise a majority of broadband households in 2025, now is the time to field research to understand their behaviors, motivations, and preferences; and to best design and pitch new video services. Such insights are critically important to all companies in the value chain, whether content creators, aggregators, distributors, or CTV hardware & software vendors. Sadly, most companies are still in flux regarding how best to serve these prospective buyers.

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge