Household media spend stabilized in Sweden in Q3

Tuesday, October 13th, 2020Mediavision – Q3: Household Media Spend Stabilizes as Corona-effects Wear Off

Mediavision’s analysis of household spend on media services points towards a stabilization in the third quarter, following substantial corona effects in Q2. During this spring, online video services reached new record levels which have now normalized. On the other hand, Mediavision concludes that spend on digital text subscriptions increase substantially.

Mediavision’s analysis of the thirds quarter show that Swedish households spend on average just over/slightly above 1400 SEK per month on media and mobile- and broadband subscriptions. Despite the pandemic, household spend remains at approximately the same level as in the same period in 2019 – a positive message for several actors, following vast declines in advertising revenue during the spring. Hence, the importance of subscription revenues is growing for the actors.

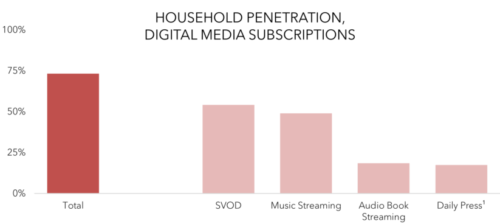

Today, three out of four households subscribe to at least one digital media subscription. Video and music services are most popular. Spend on video-services dominate, e.g. the combined cost of traditional pay-TV and digital video services. Services such as Netflix, Viaplay, HBO etc. represent a third of the total spend. Last quarter, Q2, this share was even larger, likely related to the pandemic. Another drastic change, caused by the pandemic, is that household spend on cinema decreased by 70% in Q3 2020 compared to the same period in 2019.

Focusing on digital text subscriptions, both uptake and spend has grown rapidly. Mediavision concludes that in Q3, 13% of the households subscribed to a digital daily press subscription. This is about the same level as in Q2, when penetration increased substantially driven by free-trials. In Q3, Mediavision can conclude that a large share of these subscribers is now paying for their digital daily press subscription. Consequently, household spend on digital daily press has grown substantially, over 30% compared to last year. However, spend on traditional newspapers remain at a stable level.

“The digitalization of the media market moves at high speed. Today, a Swedish household pay for 2,5 digital media services on average. Mediavision’s assessment is that this trend will only grow stronger, causing subscriber revenue for the actors to increase even further. Given that the advertising market has suffered substantially during 2020, this must be considered good news for the actors. However, the digital market is to a high degree global, causing a surge in competition,” comments Natalia Borelius, project manager at Mediavision.

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge