U.S. vMVPD subscribers rise in Q3 as traditional multichannel decline slows

Tuesday, November 17th, 2020

Virtual multichannel services lift third quarter while traditional US multichannel decline slows

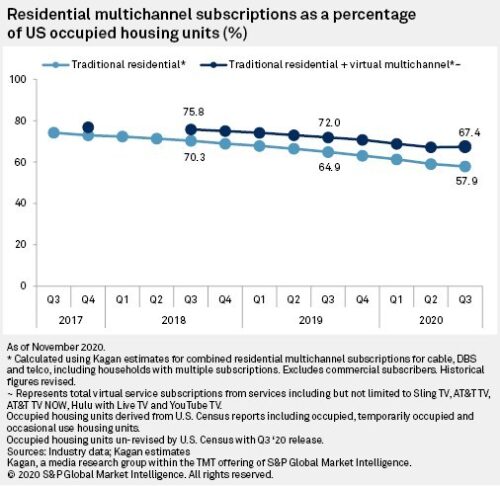

NEW YORK — The number of households in the U.S. subscribing to a package of live, linear networks made gains in the third quarter behind surging popularity for virtual multichannel packages. The combined tally of the broadband-delivered virtual offerings and traditional multichannel subscriptions reversed a prolonged slide with a sequential increase of 319,000 or 0.4%, according to full market estimates from Kagan, a media research group within S&P Global Market Intelligence.

Traditional cable, telco and direct broadcast satellite providers staunched defections in the third quarter, benefitting from broadband bundles and the return of sports programming. The traditional services still collectively lost more than 1.6 million subs in the three months ended Sept. 30 but slowed the sequential decline to 2.1%, according to Kagan estimates.

The virtual services jumped nearly 2 million in the quarter, a 19% increase sequentially that overcame the traditional losses for the first time since we began tracking the category quarterly at the end of 2018.

Additional takeaways from Kagan’s third quarter report:

- The single quarter of exceptional performance is insufficient evidence of an end to cord cutting for an industry combined total that is down 4.6% in the trailing 12 months or 4.3 million subscriptions.

- The combined penetration of traditional and virtual subscriptions, which accounts the total households in the U.S. taking a package of live, linear channels, posted rare gains to rebound to 67.4%.

- The percentage of households in the U.S. with a traditional multichannel subscription dropped to less than 58%.

Latest News

- Deutsche Telekom selects Broadpeak Cloud DVR solution for MagentaTV

- Nexxen empowers Australian advertisers using VIDAA ACR data

- TargetVideo integrates AI for video content categorization

- Meta opens Quest OS to third-party hardware makers

- Aferian to implement further cost reductions at Amino

- Paramount to exclusively represent SkyShowtime advertising sales