Investment in IPTV equipment continues despite subscriber slowdown

Tuesday, October 28th, 2008

CAMPBELL, California — The North American Internet protocol television (IPTV) and switched digital video (SDV) equipment market declined sharply in 2Q08, pulling the worldwide market down 5% sequentially to $1.27 billion despite healthy increases in EMEA, Asia Pacific, and CALA, reports market research firm Infonetics Research.

The dip in the overall market is due to slowing IPTV and SDV subscriber additions by service providers in some regions hit hard by the uncertain economic climate, particularly in North America, according to Infonetics’ report, IPTV and Switched Digital Video Equipment, Services, and Subscribers.

“In environments where the future of the economy is unknown, IPTV and SDV subscribers are more apt to stay with their current provider, rather than look for a new provider with whom they may have to invest in new equipment and other upfront fees; this is especially true in North America and Western Europe right now. However, service providers around the world–particularly in Asia, Europe, and Latin America–are still investing in IPTV equipment because offering video service is increasingly becoming a requirement to increase revenue per user. Operators will continue to add IPTV and SDV subscribers, just not at the fast clip they previously expected,” said Jeff Heynen, directing analyst for IPTV at Infonetics Research.

Other report highlights:

- North America’s share of the overall IPTV and SDV equipment markets dropped from 47% to 38% between 1Q08 and 2Q08

- The number of IPTV subscribers is forecast to hit 72 million worldwide by 2011 (forecast has been adjusted to reflect the current state of the global economy)

- In 2Q08, the huge worldwide IP set-top box market is down 10% due to the subscriber slowdown, while the nascent IP video encoder market is up 8% as subscribers seek to add channels, particularly high definition (HD) channels

- Motorola continues to lead the worldwide IP set-top box market in 2Q08, although Cisco is coming up on its heels; in Asia Pacific, Dasan and Samsung are neck and neck for the lead

- IPTV subscriber growth has been strongest in France, where a fierce battle for subscribers among Orange, Free (Iliad), and neuf cegetel has driven total subscribers there to nearly 3M at the end of 2007

- IPTV service activation times for service providers like AT&T are ranging from days to weeks, sending through the roof the cost to pass homes and turn up subscribers, prompting IPTV operators to push harder for well-defined interoperability standards

- IP STB prices are expected to decrease steadily, thanks to volume production of system-on-a-chip (SoC) designs from STMicroelectronics and Sigma Designs, as well as the entry into the market of Broadcom

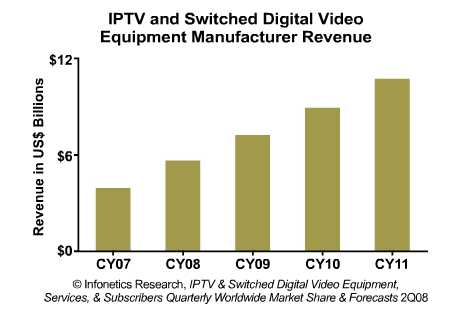

Infonetics’ report tracks IPTV and SDV equipment, services, and subscribers, providing market size, vendor market share, and forecasts through 2011. Telco IPTV and cable IPTV and SDV equipment includes pure and hybrid IP set-top boxes, integrated digital headend platforms, VOD and streaming content servers, IP video encoders, IPTV middleware and content delivery platforms, video content protection software, and universal edge QAMs. The report also tracks pure IPTV, hybrid IPTV/over-the-air, hybrid IPTV/QAM, and cable SDV services and subscribers.

Companies tracked include 2 Wire, Advanced Digital Broadcast (ADB), Alcatel-Lucent, Amino, Celrun, Cisco Systems (Scientific Atlanta), Dasan Networks, Envivio, Ericsson (Tandberg), Harmonic, Microsoft, Motorola, Netgem, Nokia Siemens, OptiBase, Philips, Sagem, Samsung, Sumitomo, Telsey, Thomson, Tilgin, UTStarcom, Yuxing, and others.

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge