HD arms race boosts IPTV equipment spending

Wednesday, March 18th, 2009

Infonetics Research: HD arms race boosts IPTV equipment spending; IPTV subscribers growing fast

CAMPBELL, CA — Communications market research firm Infonetics Research recently released the fourth quarter (4Q08) edition of its IPTV and Switched Digital Video Equipment, Services, and Subscribers report. Highlights follow.

CAMPBELL, CA — Communications market research firm Infonetics Research recently released the fourth quarter (4Q08) edition of its IPTV and Switched Digital Video Equipment, Services, and Subscribers report. Highlights follow.

“With service providers around the world countering decreasing revenue by cutting capex, one would assume video equipment providers will be hit just as hard as their network equipment colleagues; however, that won’t be the case in 2009. Encoder providers like Harmonic, Tandberg (Ericsson), and Motorola will see a continued uptick in revenue this year as they benefit from the HD arms race currently going on in North America and soon to expand to Western Europe and parts of Asia,” said Jeff Heynen, Directing Analyst, Broadband and Video, Infonetics Research.

Report Highlights

- Service provider and cable operator spending on IPTV and switched digital video (SDV) equipment increased 48% in 2008 from the previous year, hitting $3.9 billion worldwide

- The market was up 10% sequentially in the final quarter of 2008

- Spending was boosted by the shift to high definition (HD) formats and an increase in channel lineups

- Thanks to aggressive pricing on bundled service packages, there was healthy growth in IPTV subscriber numbers in EMEA (Europe, Middle East, Africa), Asia Pacific, and North America in the fourth quarter of 2008

- The number of pure and hybrid IPTV subscribers more than doubled in 2008 to 25.4 million worldwide, and is expected to grow to about 45 million in 2009

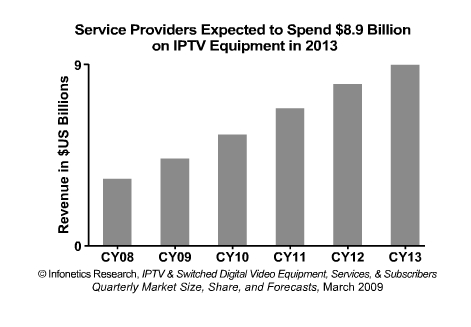

- Service providers are expected to increase their spending on IPTV equipment in the double-digit percents over the next 5 years, with spending hitting a high of $8.9 billion in 2013

- IPTV equipment includes integrated digital headend platforms, VoD and streaming content servers, IP video encoders, IPTV middleware/content delivery platforms, video content protection software, and IP set-top boxes

- In the US, a fierce battle is raging between service providers delivering IPTV (such as AT&T, Verizon, and SureWest) and cable video providers (such as Time Warner, Comcast, and Cablevision) to increase the number of high definition (HD) channels

- The same race will be heating up in other regions of the world, particularly in Europe and Central and Latin America

- Comcast has significantly slowed their SDV rollout and shifted their capex focus exclusively to DOCSIS 3.0 rollouts

Report Synopsis

Infonetics’ quarterly IPTV and switched digital video report provides worldwide and regional market share, market size, analysis, and forecasts through 2013 for telco IPTV and cable IPTV and SDV equipment, including pure and hybrid IP set-top boxes, integrated digital headend platforms, VoD and streaming content servers, HD and SD IP video encoders, IPTV middleware and content delivery platforms, video content protection software, and universal edge QAMs. The report also tracks IPTV and cable switched digital video service revenue and subscribers, and includes customizable pivot tables.

The IPTV and SDV report tracks Advanced Digital Broadcast (ADB), Alcatel-Lucent, ANT plc, ARRIS, BitBand, Celrun, Cisco Systems, Concurrent, Dasan Networks, Edgeware, Envivio, Ericsson (Tandberg), Espial, Harmonic, Huawei, Microsoft, Motorola, Netgem, Nokia Siemens, OptiBase, Pace, Sagem, SeaChange, Sumitomo, Thomson, Tilgin, UTStarcom, Yuxing, and others.

Latest News

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services

- Vantiva has shipped 22 million Android TV set-top boxes

- Newsmax launches subscription-based app with 24i

- Slovak Telekom and T-Mobile CZ upgrade video streaming with 24i

- CTV/OTT expected to be fastest growing media channel in U.S. in 2024