North American pay TV revenues to peak next year

Thursday, June 7th, 2012Pay TV revenues in North America will peak in 2013, before gradually falling by $2.6 billion to reach $88.2 billion in 2017, according to a new report from Digital TV Research. The Digital TV North America report concludes that TV ARPU is being forced down as cable operators and telcos convert their subscribers to dual-play or triple-play bundles, though blended [overall] ARPU is rising.

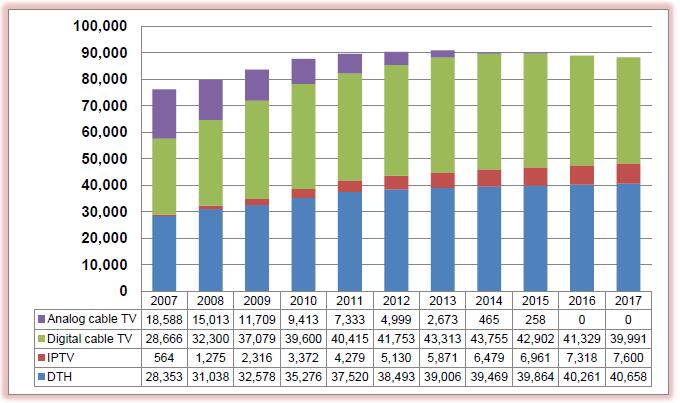

North America pay TV revenues ($ mil.)

Source: Digital TV Research

Report author Simon Murray said: “Pay TV penetration has almost reached saturation point in Canada and the US, so pay TV operators continue to fight between themselves (mainly to capture analog cable subs) for new subscribers.”

Despite no movement in the penetration figure, the number of pay TV subscribers will climb by 9 million between 2011 and 2017 to 120 million.

Digital penetration was 86% at end-2011, and will reach 100% by 2016. Of the 25 million digital homes to be added between 2011 and 2017, 13 million will come from cable, 7 million from IPTV and 4 million from DTH.

DTH ($40.7 billion) will become the largest pay TV platform earner in 2017, by overtaking cable ($40.0 billion). DTH revenues will climb by $3 billion between 2011 and 2017, with overall cable revenues falling by nearly $8 billion. Analog cable revenues will fall to zero by 2016, down from $7.3 billion in 2011 and $18.6 billion in 2007.

The number of pay DTH households will increase by 3 million between 2011 and 2017 to reach 39.8 million. However, DTH penetration will not change too much, settling at 28.9% by 2017.

There will be 65 million cable homes (all digital) by 2017, similar to the 2011 figure (of which 13 million were analog). Cable penetration will be 47.1% by 2017, down from 50.3% at end-2011.

Although most analog cable subs will convert to digital cable, IPTV will also benefit, especially considering the aggressive pricing policies undertaken by the telcos. The number of homes paying for IPTV will climb by 73% between 2011 and 2017 to reach 15.8 million – or 11.5% of TV households. IPTV revenues will increase by a slightly higher rate to achieve $7.6 billion by 2017.

More: Digital TV North America

Links: Market Research Store

Latest News

- Interactive TV news channel unveiled by ROXi and Sinclair

- Spideo and OTTera unveil personalisation collaboration at NAB Show 2024

- Amagi integrates Intertrust DRM for FAST services

- Vantiva has shipped 22 million Android TV set-top boxes

- Newsmax launches subscription-based app with 24i

- Slovak Telekom and T-Mobile CZ upgrade video streaming with 24i