Nearly Half Of All Paid Video-on-Demand Movie Rental Orders Generated by Cable Companies

Monday, September 24th, 2012

PORT WASHINGTON, NEW YORK — According to The NPD Group, a leading market research company, although renting movies through Internet video on demand (iVOD) is making inroads with a small but growing group of consumers, cable companies are consumers’ first choice when they order on-demand movies on a per-use basis. Led by Comcast in the first half of 2012, 48 percent of all paid video-on-demand (VOD) movie rentals were generated from cable VOD. With a 24 percent rental-order growth rate year-over-year, telco VOD is the fastest growing segment of the VOD market, outpacing even the iVOD growth rate of 15 percent. Please note that the information in this press release refers only to movie rentals that are paid for upon rental; subscription video rentals and video purchases are not included.

“When it comes to paying for on-demand movies on an a-la-carte basis, cable companies are by far the primary conduit, due in large part to their widespread penetration and usage in Americans’ homes,” said Russ Crupnick, senior vice president of industry analysis for The NPD Group. “Even as iVOD, and VOD from satellite-media companies and telcos grow in popularity, cable companies continue to dominate the VOD movie rental market.”

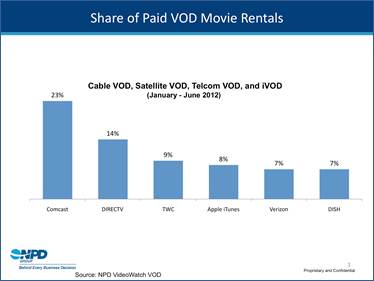

According to NPD’s “VideoWatch VOD” report for the first half of 2012, paid- VOD movie rentals from cable company Comcast represented 23 percent of the VOD rental market, followed by satellite TV provider DIRECTV at 14 percent, and Time-Warner Cable at 9 percent. Apple iTunes’s iVOD service comprised 8 percent of paid video rental transactions, followed by telco company Verizon and satellite TV provider Dish Network at 7 percent each. AT&T received the best customer ratings across a number of criteria, including site organization, navigation and title availability.

Consumer audience demographics for iVOD movie rentals skew toward tech-savvy early adopters, primarily men (70 percent). In fact 44 percent of IVOD movie rental orders were made by men aged 25 to 44, compared to only 21 percent of cable VOD rental orders.

NPD’s “VideoWatch VOD” report tracks what is driving and impeding the growth of VOD segments across the United States. It explores and explains the opportunities and threats that over-the-top (OTT) video presents, not only to established cable, telco and satellite TV operators, but also to newer Internet VOD (iVOD) retailers. It also evaluates the effects of the convergence of iVOD and pay-TV VOD on programming and pricing.

Data note: Data in this press release focuses only on VOD movie rental orders and does not include subscription VOD (sVOD), physical-disc-rental comparisons, or videos purchased via iVOD. The information based on 11,773 VOD rental transactions generated from NPD’s VideoWatch Digital Tracker. Survey data was weighted to represent U.S. population of individuals (age 13 and older) and tested for statistical significance at 95 percent confidence level.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally