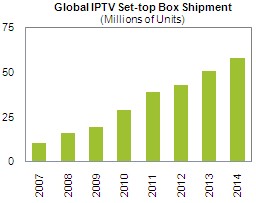

IPTV Set-top Box Shipments to Rise by Nearly 50 Percent in 2010

Wednesday, April 21st, 2010

Shipments of television Set-top Boxes (STBs) sold into the up-and-coming Internet Protocol TV (IPTV) segment are set to rise by nearly 50 percent in 2010, according to iSuppli Corp.

Global shipments of IPTV STBs, which allow the delivery of television services over a high-speed digital network, are projected to grow to 28.7 million units in 2010, up 48.2 percent from 19.4 million in 2009. Shipments will rise at a 25 percent Compound Annual Growth Rate (CAGR) from 2009 to 2014. While IPTV STBs accounted for only 14.7 percent of total set-top box unit shipments in 2009, that number is expected to rise to 19.3 percent in 2010 and to 29.1 percent in 2014.

In comparison, shipments of legacy STBs, consisting of cable, satellite and terrestrial boxes, are estimated to rise by only 6.7 percent in 2010, making IPTV the hottest segment of the market.

“In order to fulfill the promise of exciting interactive applications presented by the IPTV industry, further innovation is needed to differentiate IPTV services from those offered by the cable and satellite providers,” said Lee Ratliff, senior analyst for broadband digital home and IPTV at iSuppli. “This innovation will drive market growth in 2010 and beyond.”

The principal difference between legacy STBs and their IPTV counterparts lies in the way the boxes receive information. IP STBs receive video content over a broadband pipe via Internet Protocol data packets, while legacy boxes receive an RF-modulated signal.

Furthermore, IP boxes do not require a tuner and demodulator, which are requirements for legacy boxes.

With more than 60 vendors claiming to have an IPTV STB product, the market remains highly fragmented. However, just 15 vendors supplied 92 percent of the market in 2009. Motorola Inc. was No. 1 with 32 percent market share, followed by Cisco Systems Inc. with a 14 percent share.

Among companies supplying platform software for IPTV boxes, Microsoft Corp. held sway with its Mediaroom middleware, accounting for 25 percent of the market, which amounted to 4.8 million STBs in 2009. Microsoft had three times the share of its closest rival: French-based Thomson SA with its SmartVision software.

Next-generation media processors for IPTV STBs also will appear in 2010. Market newcomer Broadcom Corp. is expected to lay siege to incumbent leader Sigma Designs Inc. with its BCM7405 processor. The BCM7405 has been certified for Mediaroom deployments, ending the advantageous position of Sigma Designs as sole provider of Mediaroom-certified processors.

Nonetheless, Sigma Designs is expected to fire back, and its next-generation SMP8650 family of processors will benefit from the company’s position in many existing IP STB sockets.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally