2011 Flat Panel TV Growth to be Half that of 2010; Growth Shifting to Emerging Markets

Monday, May 2nd, 2011

Japanese TV Demand Falling Sharply Due to End of Government Incentive, and Earthquake Likely to Reduce Demand Further; LED Backlights and 3D Gain Share

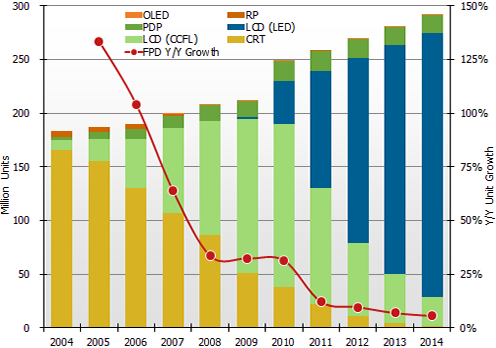

SANTA CLARA, Calif. — According to the latest DisplaySearch Quarterly Advanced Global TV Shipment and Forecast Report, total TV shipments grew by nearly 18% Y/Y in 2010 to 248 million units. However, shipment growth is expected to slow to less than 4% Y/Y in 2011, as slower price erosion cools demand in developed markets. The total TV market is increasingly defined by the replacement of CRT TVs with flat panel TVs, especially in emerging markets, as growth begins to slow for many developed countries that have strongly adopted flat panel TVs already. Flat panel TVs grew 32% in 2010 on a unit basis, but that growth will slow to 12% in 2011.

“As the household installed base for flat panel TVs increases above 50-60%, the growth rate slows, which is currently the situation in Japan, Western Europe, and North America. Emerging markets, however, are still ripe for sustained growth due to a low level of household flat panel TV penetration,” noted Paul Gagnon, Director of North America TV Research for DisplaySearch.

LCD TVs continue to be the primary TV type shipped worldwide, and are expected to account for about 84% of all TV shipments in 2011. As CRT TVs become scarce, LCD TVs will become the de facto choice for consumers looking to upgrade their CRT TVs. Worldwide LCD TV shipments will increase from about 192 million units in 2010 to almost 217 million units in 2011, a 13% increase. Total LCD TV shipments are expected to increase steadily, reaching 270 million units by 2014.

Within the LCD TV category, several key features are gaining share as cost premiums decline. LED backlights will account for about 50% of the total LCD TV units shipped during 2011, penetrating a large number of screen sizes, especially above 40″. Larger screen size sets are usually fully featured and focused on performance. As a result, performance-oriented features like high frame rate and 1080p resolution have much better penetration among larger screen sizes. 120Hz and higher refresh rates will account for about a quarter of total LCD TV units in 2011, but for 40″+ sizes, the share is more than 60%.

Plasma TV experienced a huge turnaround in 2010, with Y/Y shipment growth of 30%, up from -1.5% in 2009. Much of the growth was the result of cost-conscious consumers looking for value, as well as relatively slow ASP erosion in competitive LCD products. LCD TV ASPs were down 10% in 2010, while plasma TV ASPs fell 15%. However, DisplaySearch expects plasma TV shipment growth to slow considerably in Q1’11 and will begin to decline in the second half of the year as LCD regains share of below 50″ sizes. The global market for 50″ and larger sets remains relatively small and slow-growing.

DisplaySearch is also now tracking and forecasting 3D TV shipments by technology, size, resolution, frame rate, and backlight type, all broken down by region throughout the forecast. This data reveals that while 3D accounted for just 10% of Q4’10 global TV revenues, and over 2M units, it will quickly rise to more than 50% of revenues and 100M units worldwide by 2014 as it essentially becomes a standard feature of large screen TVs of all technology types. The penetration of 3D will be highest initially among full-featured sets, accounting for 30% of 120Hz+ LCD TVs in 2011 for example, but 3D penetration will quickly move into more basic models over the next several years. And while 3D is mainly for primary living room TVs, where 1080p is common, plasma TV manufacturers are starting to bring 3D to entry-level HD sets, accounting for about 17% of 720p resolution plasma TVs in 2011.

Figure 1: Worldwide TV Market by Technology

Source: DisplaySearch Quarterly Advanced Global TV Shipment and Forecast Report

Emerging regions, which include China, Asia Pacific, Latin America, Eastern Europe, Middle East, and Africa, will have the strongest flat panel TV growth over the next four years, averaging 17% growth each year. The Asia Pacific region is positioned for strongest growth as the late adopting India market begins to boom. By comparison, developed regions (North America, Japan, and Western Europe) will see no growth over the same time period.

The DisplaySearch Q4’10 Quarterly Advanced Global TV Shipment and Forecast Report includes panel and TV shipments by region and size for nearly 60 brands. It also includes rolling 16-quarter forecasts, TV cost/price forecasts, and design wins. This report is delivered in PowerPoint and includes Excel based data and tables. If you need further information, please call 1.408.418.1900 or email sales@displaysearch.com or contact your regional DisplaySearch office in China, Japan, Korea, Taiwan and the United Kingdom.

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge