Zero Growth in Overall TV Shipments in 2012; 3D TV Shipments to Soar 90%

Wednesday, May 9th, 2012

LCD TV Shipments to Grow 7% in 2012 to 220M Units, Despite Zero Growth in Overall TV Shipments; 2012 Looks to be a Repeat of 2011, with LCD Growing at the Expense of CRT and Plasma, and Developed Market Declines Cancelling out Emerging Market Growth

SANTA CLARA, Calif. — For the second year in a row, worldwide TV shipments are expected to remain flat. 2012 shipments to developed markets, especially Western Europe and Japan, are expected to be down 11% Y/Y, which would offset the forecasted 8% Y/Y growth in emerging markets, according to the latest NPD DisplaySearch Quarterly Advanced Global TV Shipment and Forecast Report. Even so, growth is projected to continue for the LCD TV market as it captures market share from declining CRT and plasma technologies.

“Consumers are continuing to spend cautiously in developed regions, especially in countries with high rates of flat panel TV penetration, so price differences can have a strong impact and LCD is expected to continue narrowing the price gap with plasma,” noted Paul Gagnon, Director of North America TV Research for NPD DisplaySearch. Gagnon added, “In addition, many brands are taking a more conservative approach, focusing on profits over volume at all costs, so the rate of price erosion is not expected to be as strong as in previous years, which may have some impact on demand.”

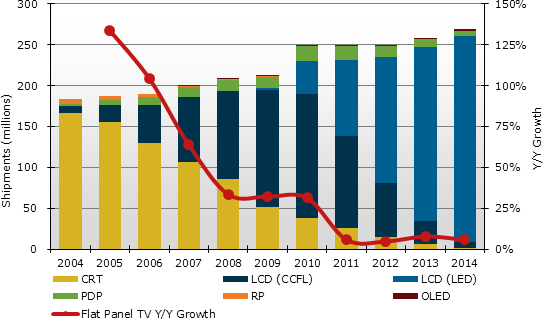

Despite no growth in overall TV shipments for two years running, LCD continues to grow by taking share from both CRT and plasma technologies. LCD TVs are expected to account for more than 88.5% of total TV shipments worldwide in 2012, up from 82.5% in 2011, and rising to more than 90% by next year. By contrast, plasma TV will account for just 5.3% of shipment volume in 2012 after peaking at about 7.4% in 2010. LCD TV shipments will grow 7% to 220M in 2012, and rise to 241M in 2013. Plasma TV shipments will fall 24% in 2012 to 13.1M, dropping to less than 3M by 2015. The newest flat panel TV technology, OLED, will debut in large sizes in 2012, but volume will be very small, just 50K units or less.

In addition to growth in flat panel TV share, larger sizes continue to increase their share, lifting the average size of TVs shipped to almost 35″ in 2012 from less than 30″ just four years ago. The growing number of larger factories used to produce LCD TV panels has helped the average area price to fall rapidly. In developed markets, this is important because it encourages existing flat panel TV households to trade up to a larger size, driving a new replacement wave, and it also lowers barriers to first-time adoption in emerging markets when converting from CRT TVs.

Figure 1: Worldwide TV Forecast by Technology

Source: DisplaySearch Quarterly Advanced Global TV Shipment and Forecast Report

LED Share of LCD TV Shipments to Reach 70% in 2012

The share of LED backlight LCD TVs is expected to increase to 70.1% in 2012, compared to just 45.3% in 2011. The primary reason for the higher outlook is the introduction of low-cost direct-LED backlight models, which have smaller premiums over CCFL backlit models. The new direct-lit LED models are bulkier than edge-lit models, but the lower premium will attract the most price-sensitive consumers. Even so, 5 times as many edge-lit LED backlight LCD TV will be shipped than direct-lit models, and the premiums for edge-lit LED LCD TVs are expected to start falling faster later in the year.

3D TV Shipments to Soar 90% in 2012

Despite a soft start in North America, 3D is proving a popular feature in other regions, helping to drive shipments of more than 24M units in 2011 and an anticipated 90% increase in 2012 to 46M units. Shipment penetration is expected to exceed 25% in both Western Europe and China and 20% in Eastern Europe. While North America is still expected to lag with 19% penetration in 2012, it should be the leading 3D shipment region by 2014, when most large screen sizes will include 3D capability as a standard feature and North America will be the top region for 40″+ TV shipments.

China LCD TV Shipments

China became the largest overall TV market in 2009 and the largest LCD TV market in 2011. However, with household flat panel TV penetration reaching high levels in urban areas, growth is expected to slow until rural cities start seeing increased adoption. LCD TV shipments are forecast to grow 11% Y/Y in China during 2012, down from 17% Y/Y growth in 2011. Some of the first evidence of this slowdown was seen in recent May Day holiday sales results in China. According to Bing Zhang, Research Director in the China Market for NPD DisplaySearch, “Analysis of sales during the recent May Day holidays in China indicates that sell-through was below expectations with low- to mid-single-digit growth and slightly elevated inventories after the end of the holiday.”

The DisplaySearch Q1’12 Quarterly Advanced Global TV Shipment and Forecast Report, available now, includes panel and TV shipments by region and by size for nearly 60 brands, and also includes rolling 16-quarter forecasts, TV cost/price forecasts, and design wins. This report is delivered in PowerPoint and includes Excel spreadsheets.

For more information on this report, please contact Charles Camaroto at 1.888.436.7673 or 1.516.625.2452, or contact@displaysearch.com or contact your regional NPD DisplaySearch office in China, Japan, Korea or Taiwan.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally