TV shipments decline, despite 4K TV growth

Wednesday, March 2nd, 2016

TV Shipments Decline, Even as 4K TV Continues Strong Growth, IHS Says

- Strong growth in China is in sharp contrast to other emerging markets

SANTA CLARA, Calif. — The abrupt weakening of global demand for TV sets, combined with continued LCD capacity expansion, caused an oversupply in the market in the second half of 2015. This shift to oversupply has resulted in extremely steep LCD TV panel price declines, but it has been difficult to pass the savings along to consumers, as inflation and currency depreciation in emerging markets have offset the cost reduction. As a result, total annual TV shipments fell to 226 million units in 2015, a 4 percent year-over-year decline, according to IHS Inc. (NYSE: IHS), the leading global source of critical information and insight. Plasma and CRT shipments have fallen to negligible levels, and while organic light-emitting diode (OLED) TV is still in the early stages of growth, shipments of LCD TVs, the dominant display technology, fell less than 1 percent in 2015 to 224 million units, compared to a 7 percent increase in 2014.

While overall TV shipments fell last year, year-over-year 4K TV shipment growth was impressive. Unit shipments rose 173 percent to 32 million units, aided by year-over-year average selling-price-per-inch erosion of nearly 30 percent. The pace of TV screen size growth slowed in 2015, and the average size of TV displays grew just 2 percent to 39.3 inches, which is about half the rate of growth in 2014. However the 4K TV mix at even mid-range screen sizes (between 40 inches and 50 inches) has been better than expected. 4K TV accounted for 50 percent of shipments of 55-inch-and-larger TVs in 2015, and 30 percent of 48-inch to 50-inch TVs.

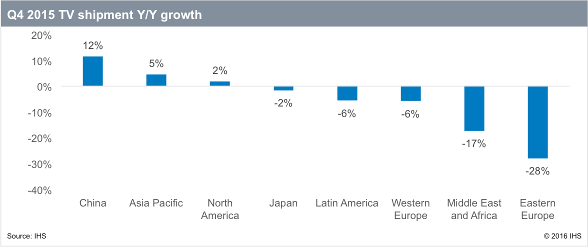

In the fourth quarter (Q4) of 2015, global TV shipments declined 2 percent year over year, as North American TV shipments grew 2 percent. While overall TV shipments in emerging markets declined 6 percent year over year in Q4, TV shipments in China surged 12 percent. Latin America TV shipments were down just 6 percent, thanks to a subsidy program in Mexico; however, TV shipments in Brazil declined 18 percent.

“TV shipment growth in China was strong in the fourth quarter, due to sell-in for the Chinese New Year Holidays, which runs counter to the very weak conditions in other emerging markets,” said Paul Gagnon, director of TV research for IHS Technology. “Like China, North America has largely been unaffected by depreciation and inflation due to the strong dollar, leading to steady, if slow, shipment growth, though inventory management remains a concern.”

The IHS TV Sets Market Tracker includes detailed information on TV shipments, by region, technology, size and resolution, for nearly 60 brands. The report also includes rolling 16-quarter forecasts and coverage of technology and price trends.

Latest News

- Netflix posts first quarter 2024 results and outlook

- Graham Media Group selects Bitmovin Playback

- Dialog, Axiata Group, Bharti Airtel agree on merger in Sri Lanka

- Yahoo brings identity solutions to CTV

- Plex has largest FAST line-up with 1,112 channels

- TV3 migrates from on-prem servers to AWS Cloud with Redge