75.9 million homes in Central and Eastern Europe have pay TV

Tuesday, June 28th, 2016

Pay TV Revenue Crosses €5 Billion Mark in Central and Eastern Europe, IHS Says

- Poland and Russia are clear market leaders; Lack of local content will hurt Netflix growth in Poland

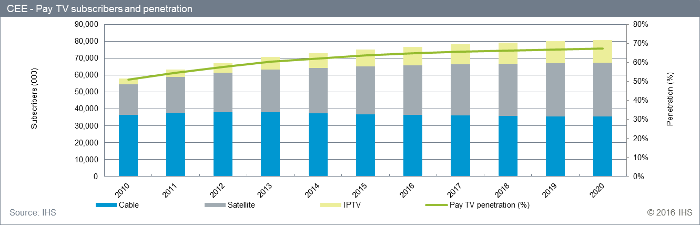

WARSAW, Poland — Pay TV revenue in Central and Eastern Europe totaled €5.02 billion in 2015, according to a new report from IHS Inc. (NYSE: IHS), the leading global source of critical information and insight. The report, entitled Central and Eastern Europe Pay TV Market Monitor, says there were 75.9 million homes in Central and Eastern Europe that had pay TV, an increase of 31 percent between 2010 and 2015.

Cable accounted for 48 percent of pay TV subscribers in 2015 compared to 38 percent for satellite and 13 percent for IPTV. Cable is predicted to keep the largest share until 2020 even though the IHS report expects the total number of cable pay TV subscribers to decline by 3 percent.

Poland – the largest pay TV market by revenue

“Poland has the highest pay TV revenue of all the Central and Eastern Europe countries, despite a much smaller population,” said Vladimir Ryazantsev, analyst at IHS Technology and report author. “Pay TV revenue in Poland increased from €1.62 billion in 2014 to €1.69 billion in 2015.”

Netflix launched in Poland in early January 2016. The launch was strongly anticipated since August 2015. However, the IHS Technology report predicted that it will not have a significant impact on the cable/Direct-to-home (DTH)/Internet Protocol television (IPTV) subscriber base unless it decreases the price, adds Polish subtitles and adds more Polish content.

Romania – pay TV market with the highest saturation in CEE

Romania’s pay TV penetration was 93 percent at the end of 2015, the highest rate in the Central and Eastern Europe region. “The percentage of the Romanian population that has pay TV is greater than the percentage of the population that has pay TV in Norway, Finland, Sweden, France, the UK, Germany and Spain,” Ryazantsev said.

Most pay TV subscribers (61 percent) were located in urban areas, with 81 percent of these opting for cable TV (according to regulator ANCOM).

Russia – pay TV market with over 38 million subscribers

Total pay TV revenue in Russia increased by 20 percent in 2015 if measured in roubles. But, in euros, the picture is much different: a 9.25 percent decline. Subscription revenue declined from €1.22 billion to €1.11 billion (the rouble depreciated by 33 percent against the euro and 59 percent against the US dollar in 2015).

In Russia, there was a flurry of deals as a result of the 20 percent cap on foreign ownership of media companies. After the sell-offs, National Media Group owns 80 percent of Discovery, Turner and Viasat channels in Russia, which together account for 20 percent of pay TV channels’ viewing time.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally