US media players get on AVOD bandwagon as market revenue soars

Tuesday, December 10th, 2019

Advertising video on-demand (AVOD) service providers in the United States are bracing themselves as media giants including Disney+ and Apple TV+ join the latest wave of competitors. Armed with a massive fan base and exclusive in-house content, these huge media firms are upping the ante, drawn by an increasingly lucrative market, according to IHS Markit | Technology, now a part of Informa Tech.

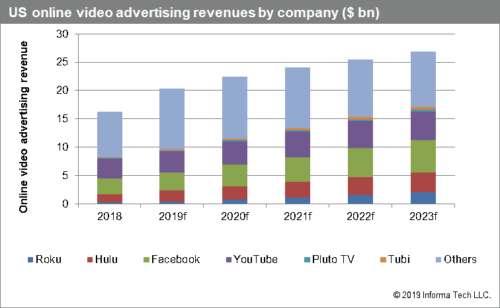

New AVOD roll-outs and improved ad-tech are expected to drive U.S. online video advertising revenue to $27 billion in 2023, growing at a CAGR of 11 percent during the period of 2018-2023, as noted by the AVOD Market Report – US – 2019.

“The AVOD goldrush is here, and it represents a prime opportunity for service providers, new AVOD entrants and content companies,” said Sarah Henschel, senior research analyst, media, for IHS Markit | Technology. “Ultimately, the winners and losers in the AVOD industry will be determined not only by content, but also by data strategies and user acquisition.”

The U.S. online video market is seeing a renewed interest in ad-supported services this year due to the maturing of the subscription video market, fears of overcrowding across over-the-top (OTT) services and limits to total consumer spending across online video platforms. This has spurred a surge in the uptake of AVOD by content owners that are increasingly opting to go directly to consumers.

As a result, companies aiming to monetize online video content through advertising now face an extra layer of complexity due to the requirements for solid ad-tech sales and data strategies, along with content and user acquisition.

Compared to a decade ago, AVOD companies are now competing in a more developed online video market that offers greater potential for digital advertising revenue and a more advanced advertising infrastructure.

Facebook and YouTube are expected to continue leading the market through 2023, trailed by Hulu, Roku, and Tubi, which are set to increase their market share.

Despite the increasing number of competitors, there remains copious opportunity for new entrants to claim a slice of the growing AVOD revenue pie. As the competition intensifies, it is important for AVOD companies to sustain strong licensing partnerships with content owners and hone their data utilization skills for ad monetization.

“With the launch of premium services like Disney+, HBO Max and Apple TV+, AVOD services can continue to benefit from cord cutting and act as a compliment to paid services,” said Kia Ling Teoh, senior research analyst, advertising and television media, at IHS Markit | Technology. “Pure-play AVOD platforms also can expand customer penetration through B2B partnerships with device makers and online linear channels.”

For studios, now is the time to test certain titles on AVOD platforms to gauge the monetization potential of their catalogs across the AVOD space. For smaller content creators and brands, the rebirth of AVOD provides an opportunity to build niche linear channels, which give them more control over how their content is programmed and viewed by consumers compared to licensing deals with streaming giants.

In terms of international expansion, Europe and Australia are popular destinations for U.S. AVOD companies. This is due to the maturity of the online video market and related infrastructure, the high cost per thousand impressions (CPM) these markets offer and the large audience for English-language or U.S.-originated content.

AVOD Market Report – US – 2019

The AVOD Market Report – US – 2019 from IHS Markit | Technology tracks the Advertising Video On Demand (AVOD) market, covering company specific strategies and revenue in the United States. The report focuses on the landscape of five main categories of AVOD services: hybrid SVOD players with AVOD, pure-play AVOD platforms, AVOD destinations, linear AVOD channels and social and user-generated platforms.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally