Limited reach of Apple TV+ and Disney+ hinders services’ adoption

Thursday, October 10th, 2019

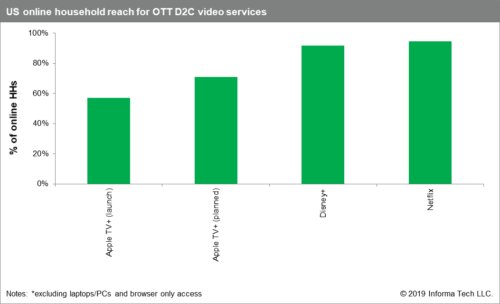

The expected launches of Apple TV+ and Disney+ in November illustrate the major shift now occurring in the TV and online video market as more firms move into the business of over-the-top (OTT), direct-to-consumer (D2C) video services. However, with the Apple TV+ app initially addressing only about half of the total U.S. market, the service is likely to encounter limited subscriber growth compared to competitive offerings that have a wider reach, according to IHS Markit | Technology, now a part of Informa Tech.

For Apple, this could come as a major disadvantage, as various services vie for screen time on the massive number of devices now capable of media streaming. A total of 11.5 billion video-streaming-ready products are expected to be connected to the internet worldwide in 2023, up from 8.9 billion in 2018, as reported by the IHS Markit | Technology Consumer Research – Devices, Media & Usage Intelligence Service – Premium.

OTT goes into overdrive

The debuts of Apple TV+ and Disney+ are part of larger wave of major launches expected in the OTT subscription video segment during the coming months. In the first half of 2020, WarnerMedia will roll out HBO Max, while NBCUniversal/Comcast will introduce its Peacock service.

“The introduction of so many major OTT services is highlighting the changing landscape of the TV and online video market,” said Fateha Begum, principal research analyst at IHS Markit | Technology. “Traditional content owners like Disney and Warner now are making big moves into providing D2C services. Meanwhile, Apple launching original programming for the first time, competing with the global OTT providers, Netflix and Amazon.”

While Disney and Warner are not new to the D2C market, their service rollouts underscore the rising importance of online platforms to those companies that traditionally dealt with pay TV operators for mass audiences.

Device distribution determines destiny

The Apple TV+ service will be initially launched on iOS devices, Samsung Smart TVs and via web browsers. This deployment will give Apple TV+ a potential addressable base of more than 70 million households in the U.S., totaling 57 percent of homes in the country. This tally accounts for households that will access the service iPhones, iPads, MacBooks, Apple TVs and Samsung Smart TVs.

In contrast, Netflix reaches 95 percent of U.S. households and Disney+ is expected to address 92 percent. These services are available on a much broader set of platforms. However, it’s worth noting that the growth of Disney+ will be driven by its availability on Android mobile devices. Excluding this, the addressable market for Disney+ shrinks due to a lack of smart-TV partnerships

“With its limited device distribution, Apple TV+ will be accessible to just over half the online population in the U.S., thus hindering subscriber growth,” Begum said. “Although Apple is the largest smartphone brand in the U.S. [JC1] market and plans to offer free access with hardware purchases, the company would need to widen its device distribution to compete with OTT players that are now available nearly universally.”

In order to be on the main TV screen in the household, Apple must make Apple TV+ available on third-party devices, including competitors’ digital media adapters, Begum added. Launches on Roku and Fire TV devices, along with Sony, LG and Vizio smart TVs, are expected after launch, although dates are yet to be announced.

“By opening up to other platforms, Apple TV+ will see its addressable base increase by 24 percent to 87 million U.S. households,” Begun said. “This will improve Apple’s position, but the company will still be at a disadvantage compared to competitors who can address the entire U.S. market of 124 million online households.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally