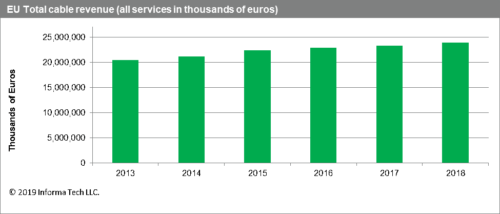

EU cable revenue hits all-time high of €24 billion in 2018

Wednesday, November 13th, 2019

European Union cable market revenue hits all-time high of 24 billion euros in 2018 as broadband demand thrives

- Growth in internet subscriptions drives market expansion

LONDON — Driven by rising consumer demand for broadband services, European Union cable market revenue rose to a record high of 24 billion euros in 2018, up 3 percent from 23.3 billion euros in 2017.

The all-time-high revenue results were propelled by continued growth in the total number of cable revenue generating units (RGUs) in the EU, according to the European Broadband Cable Yearbook offered by Cable Europe and IHS Markit | Technology, now a part of Informa Tech. Regional RGUs increased by about 1 million in 2018 to reach an annual high of 121.7 million, up from 120.6 million in 2017. The majority of the RGU growth originated from the broadband sector, where consumers are continuing to add subscriptions to cable internet services.

“Carrying on the trend from 2017, broadband remained the primary growth engine for the European Union cable business in 2018, generating new RGUs and spurring the market’s revenue expansion,” said Maria Rua Aguete, executive director of media, service providers and platforms for IHS Markit | Technology. “European cable operators have successfully diversified their offerings into complete bundles of video, voice and internet services. This has positioned them to capitalize on the voracious consumer appetite for broadband.”

Broadband subscriptions underpin cable market growth

Measured in terms of subscriptions, RGUs for cable internet service amounted to 38 million in 2018, up from 37.1 million in 2017. This growth helped drive the increase in overall EU RGUs for the year.

Internet RGU growth outperformed the other services offered by cable providers in the region. EU subscriptions to cable TV declined by 275,000 in 2018.

With broadband revenue and subscribers continuing to expand in the coming years, internet access could become the main business for European cable operators in the future.

“Television service still accounts for the largest share of the EU cable business, representing 45 percent of revenue in 2018,” Rua Aguete said. “However, TV’s portion of the business is on the decline as internet service claims a larger and larger piece of the market. Internet service totaled 35 percent of revenue in 2018, potentially putting this area on track to become the sector’s largest revenue generator in the coming years.”

The deployments of DOCSIS 3.0 and 3.1 are playing a major role in stimulating consumer demand. DOCSIS 3.1 in particular is delivering a major leap in data speeds, attracting increased interest among internet users.

Growth and consolidation

Now more than ever, the European cable sector is becoming characterized by convergence, with 2018 marking several significant mergers and acquisitions. These activities have resulted in the creation of major quad-play service providers that are able to deliver comprehensive bundles—including the broadband internet services that are propelling the growth of the industry.

The good and the bad news for the EU cable business

Other significant developments in the EU cable market in 2018 included:

- EU cable-TV service subscribers, which increased for the first time in nine years in 2017, declined in 2018, falling by 275,000 homes.

- Digital cable subscribers continued to rise in the region, increasing by 4 million to reach 45.2 million in 2018, as operators successfully converted significant numbers of subscribers from analog TV to higher-value digital services.

- Based on the power of bundled services, EU cable operators have grown total ARPUs by €9 over 10 years by selling more services.

- Europeans still receive their pay TV via cable more than any other technology, despite the toughest competitive environment ever.

- DOCSIS 3.1 deployments have accelerated through 2018 and 2019 as operators look to offer gigabit speeds, and cable meets the challenge from fiber-to-the-home (FTTH).

About the Cable Yearbook

The European Broadband Cable Yearbook, produced in association with trade body Cable Europe, is widely recognized as the definitive guide to the European Cable Industry. Now in its 19th edition, this annual report contains detailed data on the size and value of the cable industry in all European Union countries as well as other European Economic Area markets. With company-level information and market-wide analysis, it shows trends in cable uptake, digital progression, revenue and ARPU, broadband cable and cable telephony. It also includes a written summary of the cable industry developments within each country over the last year.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally