Subscriptions now account for nearly 86% of US internet TV and movie spending

Tuesday, September 17th, 2019

Parks Associates’ OTT Video Tracker analyzes competition from new vMVPD services in OTT video space

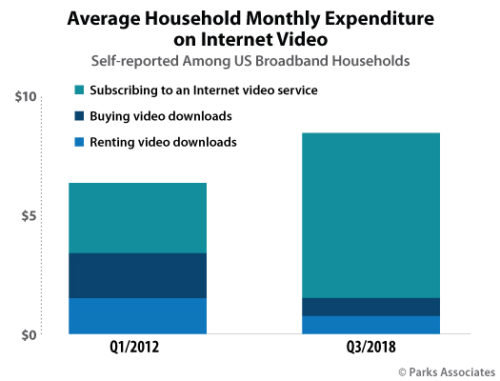

New research from Parks Associates finds that subscriptions, formerly representing just over half of total online video spending in 2012, now account for nearly 86% of all internet spending on TV and movies. The research comes from the firm’s OTT Video Market Tracker, which includes an exhaustive analysis of market trends and profiles of OTT video service providers in the US and Canada, including Netflix, HBO, YouTube, and Amazon as well as new services Disney+ (Walt Disney Co.), HBO Max, and Frndly TV. The Tracker helps companies keep up with the rapid emergence of OTT services and provides details on current players, new entrants, and trends in the OTT video services market.

“The new services launching over the next several months are taking different approaches as they enter a crowded OTT market,” said Brett Sappington, Senior Research Director and Principal Analyst, Parks Associates. “While the US market is important for Disney, the company will ultimately measure the success of its Disney+ service on a global scale. AT&T likely sees its AT&T TV offering as the evolution of its core pay-TV business rather than as an extension of its vMVPD efforts. The Frndly TV is a niche play, targeting a specific group of consumers with a low price and family-friendly content.”

These and other new services due for release, including Apple TV+, will drive consumers to increase spending on internet video and maximize the proportion of spending on subscriptions. The increasing number of new services will also test consumers’ tolerance for adding new accounts to their monthly expenditures.

“The amount of money consumers spend per month will spike, at least in the short term, as new services such as Disney+ and Apple TV+ become available. Tradeoff decisions will come later,” Sappington said. “To keep consumers spending at this higher level, services will have to consistently deliver volumes of compelling content within an engaging user experience.”

The OTT Video Market Tracker features monthly updates on trends and market activities in the OTT video space. Additional features:

- Comprehensive tracking of the OTT video services industry

- Identification of new OTT video service players, along with industry implications for new services

- Changes among existing OTT players, including pricing and business models

- Current updates and insights into industry trends and disruption

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally