U.S. consumers spend nearly seven hours per week watching online video

Wednesday, July 1st, 2020

Consumers spend nearly seven hours per week watching online video, and almost half subscribe to two or more OTT services

- Industry report addresses strategies for MSOs and set-top box makers as markets adjust to high demand for streaming services

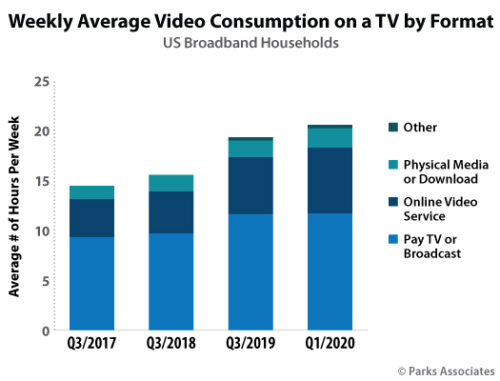

DALLAS — Parks Associates announced new research today showing the number of hours per week consumers spend watching online video has almost doubled from 3.6 hours per week in 2017 to nearly seven hours per week in 2020. Set-top Box Innovations and Trends also notes traditional pay-TV service has declined from an adoption rate of 75% to 62% in U.S. broadband households between Q1 2017 and Q1 2020, which led a subsequent decline in set-top box adoption.

“Parks Associates consumer surveys find that 74% of US broadband households subscribe to at least one streaming service (often called OTT – Over-The-Top), and almost half of US broadband households subscribe to two or more services,” said Dr. Kenneth Wacks, Contributing Analyst, Parks Associates. “The top three OTT subscription services in the US are Netflix, Amazon Prime Video, and Hulu. Newcomers Disney+ and Apple TV+ have grown quickly to round out the top five. Notably, Disney reports having 50 million subscribers as of April 2020. Additional services of note include CBS All Access, Crackle, Fubo TV, BHO Not, Philo, Pluto TV, and Sling TV.”

These OTT services allow households to access premium video content without a set-top box, forcing a change in the relationship between set-top box (STB) makers and cable/satellite operators. Content developers and networks are now streaming content directly to consumers or distributing through OTT service providers. In some cases, multiple-system operators (MSOs) are launching their own streaming devices or creating offerings similar to vMVPDs (virtual multichannel video programming distributors) with the goal of recapturing pay-TV cord-cutters or cord-nevers.

“The set-top box does have a role in this market, but it will have to adapt,” Wacks said. “For one, it can serve as the device to aggregate the variety of different services coming into the households and present them in a personalized and attractive UI for an improved consumer experience. They can also integrate other use cases and innovations, such as voice control and smart home controls, to expand the set-top’s role in the home.”

Set-top Box Innovations and Trends identifies MSO strategies to stay relevant, highlights new methods for accessing traditional TV, and examines how set-top box makers and cable operators are adjusting by establishing new business relationships and adding set-top box features to retain customers.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally