61% of US broadband households subscribe to two or more OTT services

Monday, November 23rd, 2020

New industry report evaluates potential impact of new SVOD services in OTT market

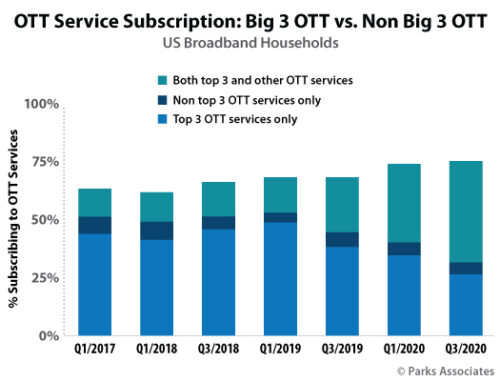

New research in Parks Associates’ The Next ‘Big 3’ in OTT finds 61% of US broadband households subscribe to two or more OTT services as of 3Q 2020, up from 48% the previous year. Forty-five percent subscribe to three or more, up from 27%, and 31% subscribe to four or more, up from 14%. The Next ‘Big 3’ in OTT evaluates this rise in service stacking and the impact of new SVOD services, including Disney+, HBO Max, Peacock, and Apple TV+, plus an expanded CBS All Access, on the dominant Big 3 in OTT: Netflix, Amazon Prime Video, and Hulu.

“The term ‘streaming wars’ has been used for the past several years to describe the battle between high-profile SVOD services to capture revenue and viewership among US video consumers,” said Steve Nason, Research Director, Parks Associates. “So far the main battle has been among the Big 3: Netflix, Amazon Prime Video, and Hulu, with other services primarily acting as complements. Now other services from major players are vying to become a core video service in US households, which represents the first real threat to the hierarchy established by the Big 3.”

November 2019 saw the launch of the two major OTT SVOD services Disney+ and Apple TV+. WarnerMedia’s SVOD service HBO Max launched at the end of May 2020. NBCUniversal’s hybrid ad-based/SVOD service Peacock fully launched in mid-July and is a formidable threat to the top tier of OTT services. ViacomCBS is in the process of expanding its highly successful CBS All Access service, which will become Paramount+ in early 2021.

Parks Associates notes that the COVID-19 pandemic further stirs up competition at the top of the OTT ecosystem, as viewers are suddenly spending more time at home, with entertainment options outside the home severely limited. US consumers are also facing an economic crisis that could drive them to limit their household spending, although people so far are showing a willingness to maintain multiple OTT subscriptions at once.

“Clearly, the five main challengers to the Big 3 are having a direct impact on the service stack of OTT consumers,” Nason said. “These services are primarily responsible for building up the OTT video portfolio by filling in important content gaps not currently being delivered by the Big 3 and other services. As these challengers continue to be more fully integrated into the market, their impact on the video consumer service stack will continue to grow.”

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally