DEG releases mid-year 2021 home entertainment report

Tuesday, August 10th, 2021

DEG: The Digital Entertainment Group today released its Mid-Year 2021 Home Entertainment Report compiled by DEG members, tracking sources and retail input.*

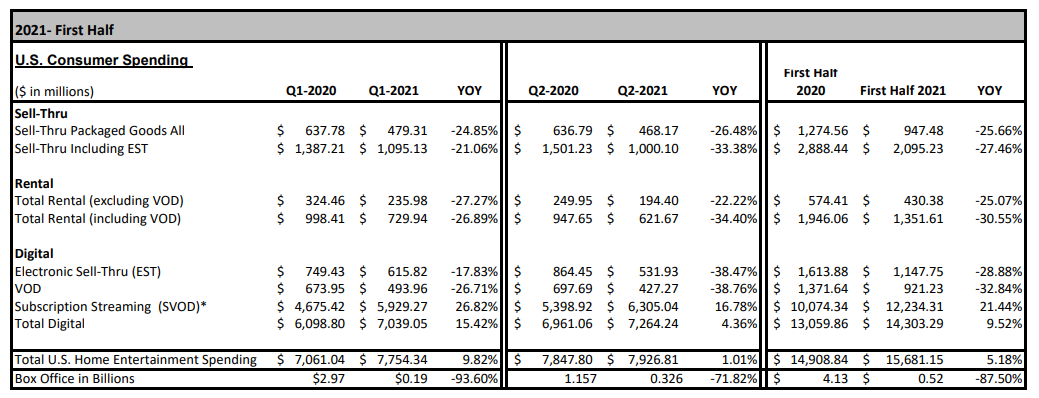

- Home Entertainment Spending Rose 5% to $15.7 Billion in 2021 First Half Amid Challenging Pandemic Comparisons

- Industry Shows Stability Despite Lack of Theatrical New Releases

Consumers spent $15.7 billion on movies and television shows consumed at home and on the go in the first six months of 2021. For the full first half, spending rose 5 percent from the $14.9 billion consumers spent in the first six months of 2020, which was a record-breaking period for home viewing as consumers limited out-of-home activity in response to the spread of the novel coronavirus. Second quarter growth year-over-year was 1 percent, for a total of $7.9 billion.

Factors limiting 2021 growth include a dearth of theatrical new releases, which are historically a key driver of home entertainment spending. Due to theater closures during the COVID-19 pandemic, few new releases made their way to market in the first half of the year, and those that did were often released initially for rental or sale in a premium window, the spending on which was not reported by any major studio in the first six months of 2021.

When compared against the comparable pre-pandemic period in 2019, however, total U.S. home entertainment spending in 2021 shows growth of more than 35 percent for the second quarter and 32 percent for the first half, demonstrating consumers’ continued strong engagement with content. Internet delivered video-on-demand (VOD**) rentals grew 24 percent in the first half of 2021, compared to the same period in 2019.

Among the highlights for the Second Quarter and First Half 2021:

- Consumer spending on subscription streaming rose almost 17 percent to $6.3 billion for the second quarter, and by 21 percent to $12.2 billion in in the first six months of 2021, fueled by consumer interest in multiple major services launched in the past 18 months. With many theaters closed during the pandemic, some new titles were made immediately available on streaming services including Disney+, HBO Max, Amazon and others simultaneous with, or in place of, a theatrical release.

- The top titles rented and purchased by consumers in the second quarter 2021 demonstrated viewers’ appetite for a variety of content. Among the top titles of second quarter 2021 were The Croods: A New Age, Godzilla vs. Kong, The Marksman, Wonder Woman 1984 and Tom & Jerry.

- Given the lack of theatrical new releases, spending on library titles is notably strong. Since second quarter 2019, digital catalog sales have grown at an annualized rate of 17 percent, significantly higher than their 4 percent growth in fourth quarter 2019, just before the pandemic. Popular catalog titles in the period included Fast and the Furious 1-8, Game of Thrones, Harry Potter – Complete 8- Film Collection, John Wick Triple Feature, The Office, A Quiet Place, and Yellowstone.

- Premium window rental and sales results currently are not included in industry reporting; however, early insights suggest that interest is high, and results are strong.

- The 5 percent increase in U.S. digital entertainment spending in the first half came amid a nearly 88 percent drop in box-office performance for the films released in the period, due to prolonged movie theater closures as a result of COVID-19 pandemic restrictions.

* Please note, these numbers are preliminary. Final numbers will be available in early fall. Please contact DEG for an updated version.

** VOD spending does not include premium video on demand (PVOD). Including PVOD would increase the total consumer spend on digital transactions.

Disclaimer: This report contains information compiled from sources that the DEG believes have accurately reported such information, but which the DEG has not independently checked or verified. As such, the DEG does not warrant its accuracy or reliability. The report is not intended to provide investment or securities advice.

* SVOD data sourced from Omdia. Disclaimer: The data is not an endorsement and reliance is at a third party’s own risk.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally