Significant growth in U.S. smart TV and smart speaker/display adoption

Wednesday, September 29th, 2021

Adoption of smart TVs and smart speakers/displays rose to 56% and 53% during pandemic, significant growth since 2019

- New Consumer Insights Dashboard tracks adoption, purchases, and demand across most common consumer electronics product categories

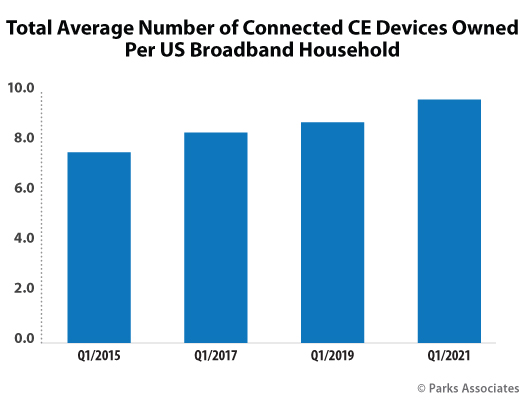

DALLAS — Parks Associates today announced the release of its latest Consumer Insights Dashboard, a new ongoing service that analyzes the firm’s quarterly surveys of 10,000 US broadband households to track consumer adoption of home devices and services. The firm’s Consumer Electronics Dashboard reveals that among the most commonly adopted CE device categories, smart TVs and smart speakers/displays showed significant growth during the COVID-19 pandemic. Smart TVs reached 56% while smart speakers/displays reached 53%.

“Big announcements in the smart TV space by Amazon and Comcast are evidence of where the home entertainment market is headed,” said Paul Erickson, Senior Analyst, Parks Associates. “TVs are now consumers’ most common video centerpiece in the home, and technology powerhouses are vying to own this point of entertainment aggregation – and all the data that goes with it – by controlling the platform itself. The competition now is not just about providing access to entertainment, it’s also about adding increasing value to the platform through features such as voice assistants, smart home integration, and better user experiences. Smart TVs are now seen as a key anchor device for ecosystem penetration into today’s broadband households.”

Purchase intentions were elevated at the beginning of the year for a variety of entertainment and productivity devices due to increased time spent at home. Q1 purchase intentions are often low due to seasonality — consumers’ holiday purchases can depress Q1 intentions. However, the pandemic grew consumers’ perceived value of connected entertainment devices, generating growth in future purchase intentions for all product categories related to connected home entertainment.

“Consumer electronics device manufacturers are best served by product strategies accounting for consumers’ increased use of devices at home for work and streaming entertainment purposes,” Erickson said. “While mobility remains important, consumers now see renewed value in at-home work and lifestyle use cases.”

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally