AR/VR headset market forecast to decline 8.3% in 2023

Wednesday, December 20th, 2023

AR/VR Headset Market Forecast to Decline 8.3% in 2023 But Remains on Track to Rebound in 2024, According to IDC

NEEDHAM, Mass. — Worldwide shipments of augmented reality and virtual reality (AR/VR) headsets are expected to decline 8.3% year over year to 8.1 million units in 2023, despite the launch of new headsets during the year, according to new data from the International Data Corporation (IDC) Worldwide Quarterly Augmented and Virtual Reality Headset Tracker. Sony’s PSVR and Meta’s Quest 3 have certainly been well received but macroeconomic pressures on households combined with slowing spend in the commercial segments have put a damper on growth.

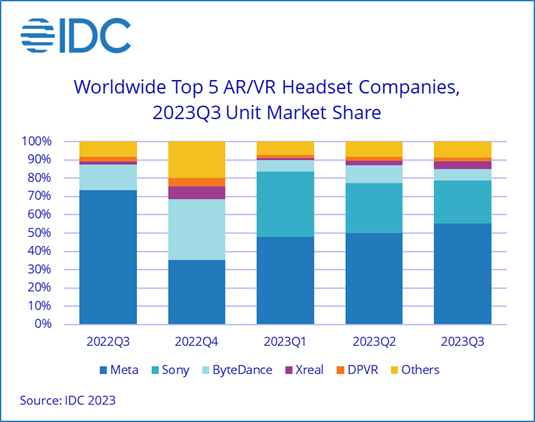

However, 2024 is shaping up to be a year of tremendous recovery as shipments of AR/VR headsets are expected to grow 46.4%. The return to form is thanks to a full year’s availability of Meta’s Quest 3 as well as Apple’s Vision Pro, which is expected to bring lots of attention but will likely ship fewer than two hundred thousand units in the year. In contrast, Meta, the market leader in 3Q23 who captured 55.2% share, has already managed to ship over 10x Apple’s expected volume in the first three quarters of 2023 (prior to the launch of Quest 3) and will likely experience year-over-year growth in 2024.

“While the new VR headsets are expected to drive volume, they also risk alienating some consumers as average selling prices trend upwards,” said Jitesh Ubrani, research manager, Mobility and Consumer Device Trackers at IDC. “The high price tag of the Vision Pro will likely relegate the device to businesses, while the Quest 3, which is more accessible, is also pushing the limits of consumers’ wallets making VR a delight for the affluent, particularly as production ramps down on older and more affordable headsets.”

Meanwhile, AR headsets are also expected to grow in 2024 due to the availability of lower cost tethered headsets from the likes of Xreal and Rokid, which tend to serve as monitor replacements while enhancing productivity or improving the media consumption experience. More sophisticated standalone headsets such as Microsoft’s HoloLens 2 or the Magic Leap 2 will continue to proliferate, though at a slower pace than tethered AR headsets. In total, AR headset shipments are forecast to reach to 845,000 in 2024, up 85.6% compared to 2023.

“Volumes of AR headsets are expected to move at a slower pace compared to VR headsets, but diversification among the different products will increasingly address more needs,” added Ramon T. Llamas, research director with IDC’s Augmented Reality and Virtual Reality program. “3D immersive and interactive augmented reality will still receive most of the attention and find their way to enterprise users. Assisted reality (AR headsets that simply show content within a user’s line of sight) will likewise have its own audience, and can branch out towards consumers with gaming and multimedia. Finally, the recent attention towards mixed reality will raise the profile for augmented reality, especially for those who only want or need an AR experience.”

Worldwide AR/VR Headset Forecast by Product Category: Shipments, Year-Over-Year Growth, and 2023-2027 CAGR

(shipments in millions)

2023 2023/2022 2027 2027/2026 2023-2027 Product Category Shipments Growth Shipments Growth CAGR ----------------- --------- --------- --------- --------- --------- Augmented Reality 0.5 63.5% 6.8 85.5% 96.5% Virtual Reality 7.6 -10.7% 21.9 26.7% 30.1% ----------------- --------- --------- --------- --------- --------- Total 8.1 -8.3% 28.6 37.0% 37.2%

Source: IDC Worldwide AR/VR Headset Tracker, December 18, 2023

Links: IDC

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally