Global TV shipments fell 3% in 2023

Monday, February 26th, 2024

2023 Annual TV Shipments Fall 3%; Chinese Consumers Drive Premium Segment Growth

- Counterpoint Research initiates global TV coverage with first joint DSCC shipment tracker

- 2023 annual global TV shipments fell 3% to 223m units

- North America market strength not enough to offset China and Europe weakness

- The premium segment fell 1% during the year despite extremely strong growth in China

- We expect premium to grow by mid-single digits in 2024 on US and Europe recovery

LA JOLLA, CA — Counterpoint Research is initiating coverage on Global TV shipments with its Global TV Shipment Tracker, a quarterly report split by region, screen size, resolution, ASP and other features. It is the company’s first joint product with DSCC since acquisition, with the latter providing enhanced details on premium segments including advanced display technologies across OLED (includes QD-OLED), Mini/MicroLED, quantum dot LCD and others.

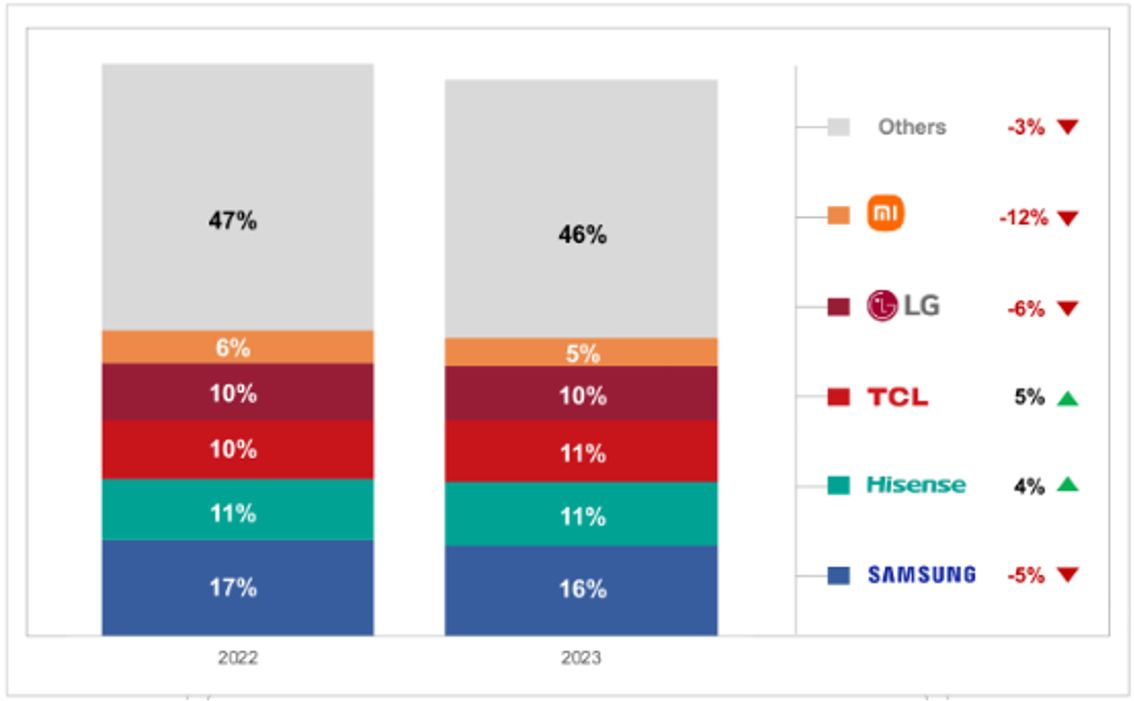

Source: Counterpoint Research Global TV Shipment Tracker

“We’re really excited to roll out the Counterpoint Research Global TV Tracker which is a powerful tool helping users assess market and technology trends as well as the competitive environment,” says Tom Kang, Research Director. “As the first joint product built between Counterpoint and DSCC, it also shows how we’re bringing additional value to clients with the net result much greater than the sum of its parts.”

According to Counterpoint Research’s Global TV Shipment Tracker, 2023 shipments fell 3% annually to 223m units as strength in the US market was not enough to offset market declines across China and Europe.

Source: Counterpoint Research Global TV Shipment Tracker

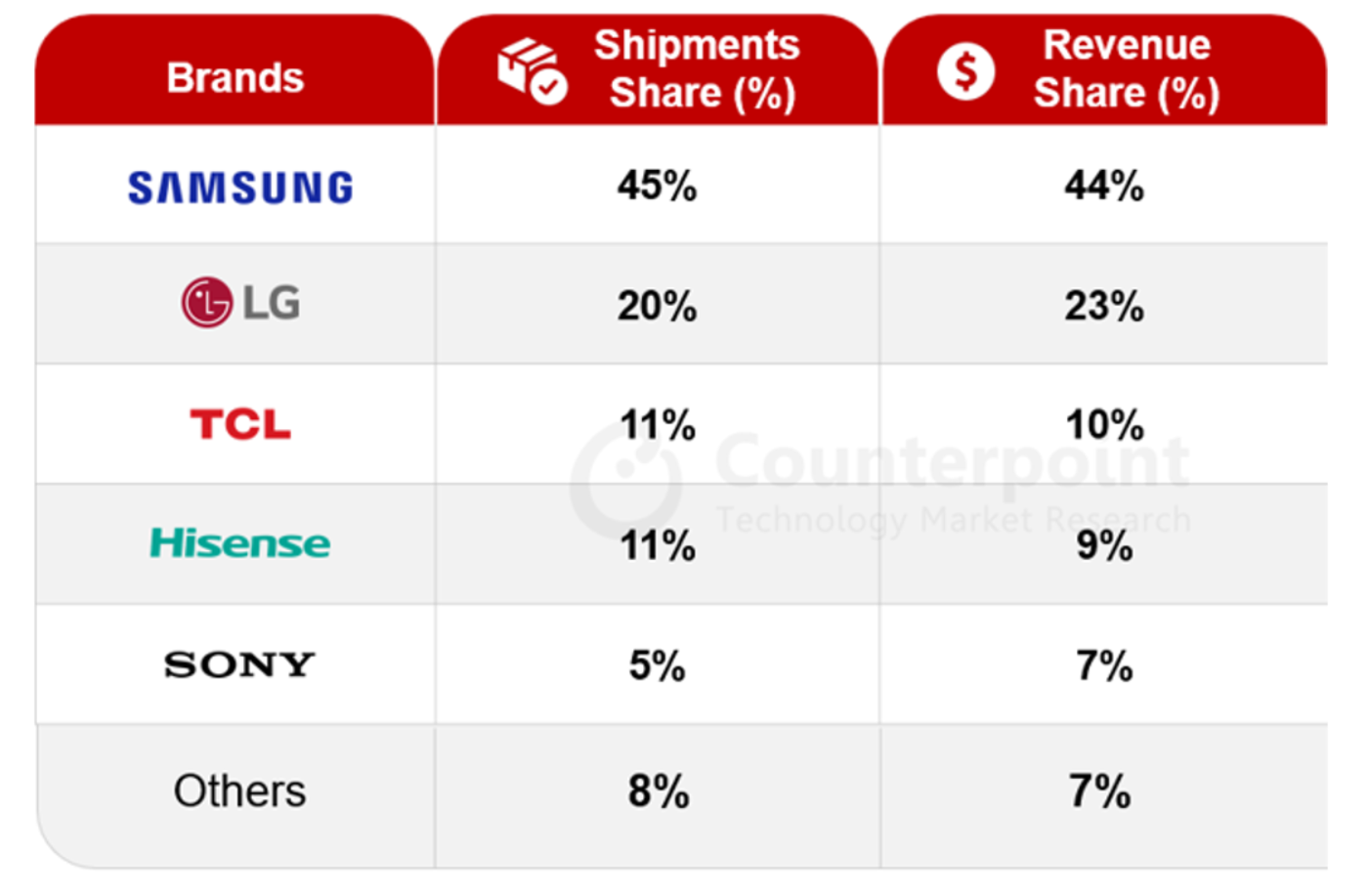

Samsung Electronics remained in top spot while Chinese vendors Hisense and TCL grew by mid single digit percentages riding the growth in North America.

Premium shipments for the year decreased 1% annually but increased to 10% of the overall market helped by a surge in China, which grew by an astonishing 39% and 49% in shipments and revenues, respectively. A clear shift towards MiniLED LCD TVs by key Chinese OEMs coupled with aggressive pricing and promotions helped to drive the segment domestically.

Links: Counterpoint Research

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally