Smart TV share in India’s TV market at record 89% in Q1 2022

Tuesday, June 7th, 2022

Smart TV Share in India’s Overall TV Market at Record 89% in Q1 2022

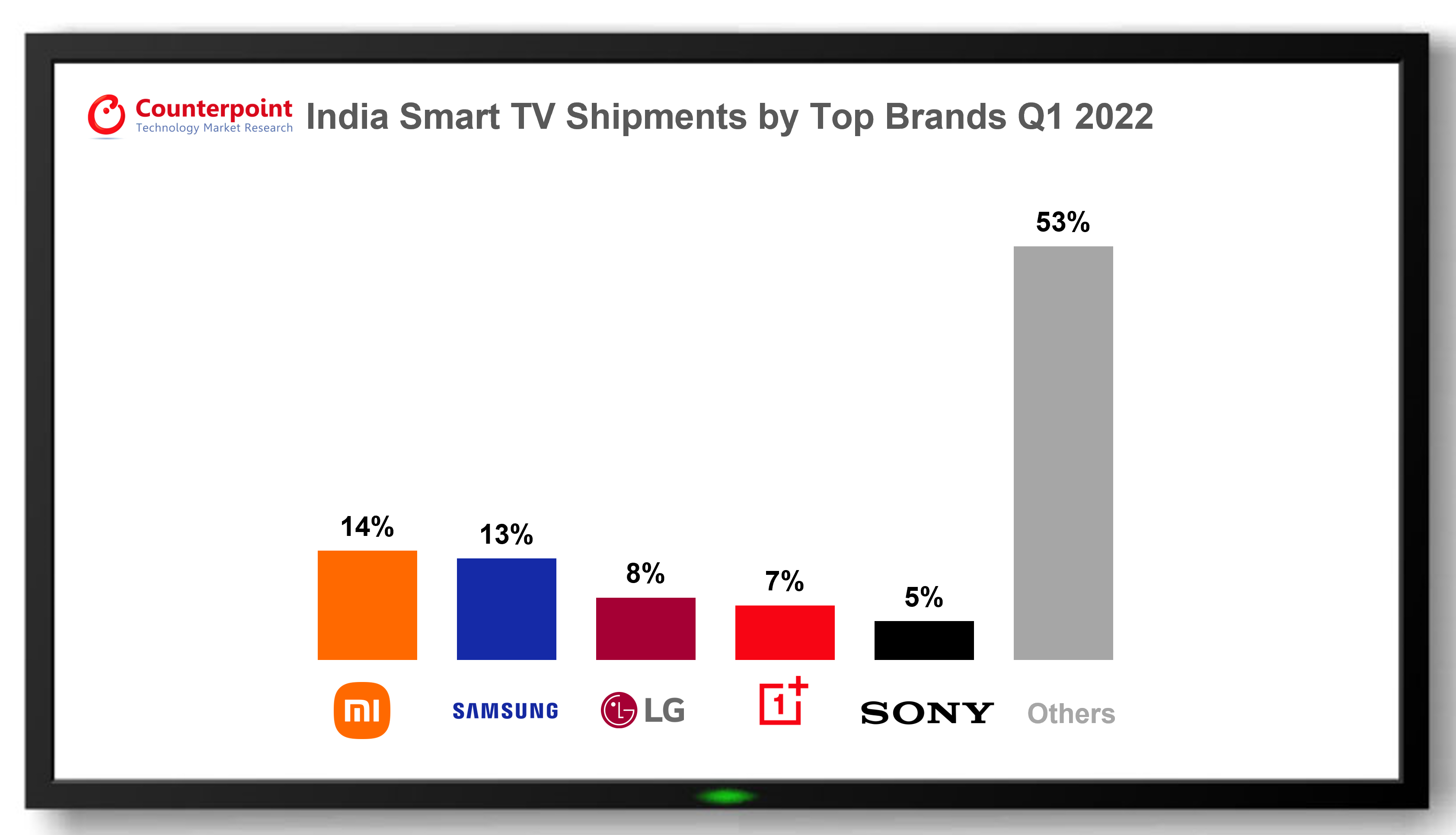

- Xiaomi led India’s Smart TV market in Q1 2022 with a 14.3% share, while Samsung and LG took the second and third spots respectively.

- The INR 10,000-INR 20,000 price band captured over 40% share in the overall TV market.

- The share of TVs with 43” and above screens is increasing as people are shifting to bigger screens.

NEW DELHI, BOSTON, TORONTO, LONDON, HONG KONG, BEIJING, TAIPEI, SEOUL — Smart TV share in India’s overall TV market grew 33% YoY in Q1 2022 to reach its highest ever at 89%, according to the latest research from Counterpoint’s IoT Service. Xiaomi led the smart TV market during the quarter with a 14.3% share, followed by Samsung at 13.1%. The increased preference for smart TVs along with sales growth in online channels were the major growth drivers. New launches from leading brands at affordable prices, along with discounts and promotions, also aided in the shipments.

Source: India Smart TV Shipments Model Tracker, Q1 2022

Looking at the overall market, Senior Research Analyst Anshika Jain said, “The smart TV contribution in the overall TV market reached its highest ever in Q1 2022 at 89%. Xiaomi continued to lead the smart TV segment, followed by Samsung and LG. OnePlus reached its highest ever share due to the good performance of its Y1 series. Brands are putting more emphasis on the display aspect as there has been an increased preference for bigger display sizes. The display size range from 43 inches to 54 inches now contributes to almost one-third of the total smart TV shipments in India. In addition to this, an increasing number of models are being launched in the market with OLED and QLED technologies to enhance the user experience.”

On the market trends, Research Analyst Akash Jatwala said, “The smart TV market is showing immense growth driven by the rising demand for home entertainment, a wide variety of affordable launches, an increase in broadband penetration, and multiple discounts offer from retailers. Besides, consumers are opting for enhanced specifications to get a better viewing experience, like sound system improvements and larger screen sizes. Online channels contributed to 31% of the overall TV shipments with 30% YoY growth. They had special discounts on TVs, which helped drive the overall volume. Flipkart dominated these channels”

Commenting on the price range, Jatwala said, “The contribution of the premium TV segment (>INR 30,000) grew 68.6% YoY from 23.5% in Q1 2021 to 33.6% in Q1 2022 as brands are launching more products in the segment with enhanced features such as Dolby Support, better speakers, OLED/QLED display and bigger screen sizes. Due to this, the average selling price (ASP) increased 10.8% YoY in Q1 2022.”

Market Summary

- Xiaomi led the smart TV segment in Q1 2022 with a 14% market share. Xiaomi’s Mi 4A series and Redmi series were its major volume drivers. It also launched the Redmi Smart TV X43 during the quarter. The model contributed around 7% to Xiaomi’s total volume.

- Samsung took the second spot with 13% share of the smart TV during Q1 2022. During the quarter, Samsung organized the Samsung Big TV Festival, where it offered Galaxy Tabs, Soundbars, cashback, and more on selected models of 55” and above.

- LG had an 8% share of the smart TV market in Q1 2022. During the quarter, LG launched some bigger-screen TVs and OLED TVs.

- Sony had a 5% share of the smart TV market in Q1 2022. During the quarter, Sony launched new models in the W series and X series.

- OnePlus captured the fourth position with a 7% share in smart TV shipments. During the quarter, OnePlus launched the Y1S Edge range of TVs, which has performed well in the market.

- realme was one of the most preferred smart TV brands in the

- TCL saw its smart TV shipments increase by around 58% YoY. The S5200 series was one of its bestsellers and accounted for most of its volume. TCL is also planning to launch smaller screen size Mini-LED TV and QLED TV in India.

- VU increased its QLED TV offerings by launching the Glo QLED TV series.

- Share of smaller brands such as BPL, Haier, Toshiba, and Sansui increased during the quarter, as they are becoming popular and offering products at discounts.

- India’s smart TV market is mostly offline-driven, with 69% of the shipments happening in offline channels. But online channels are increasing and offering various discounts.

Note: Xiaomi’s share includes Redmi’s share

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally