42% of US consumers are SVOD 'resubscribers'

Monday, July 8th, 2024Subscribe, cancel, repeat: 42% of US consumers are SVoD ‘resubscribers’

- But bundles are key to mitigate the cancel and resubscribe cycle in a saturated market

LONDON — The latest research from Ampere Analysis shows that Disney subscribers who had previously churned and then returned (aka ‘resubscribers’) to take the Disney+/Hulu/ESPN+ bundle are 59% less likely to churn within 12 months than those who take Disney+ alone. This finding suggests bundling streaming services will have a significant impact on the 42% of US streaming subscribers who ‘regularly subscribe, cancel and resubscribe’ (according to Ampere Consumer data).

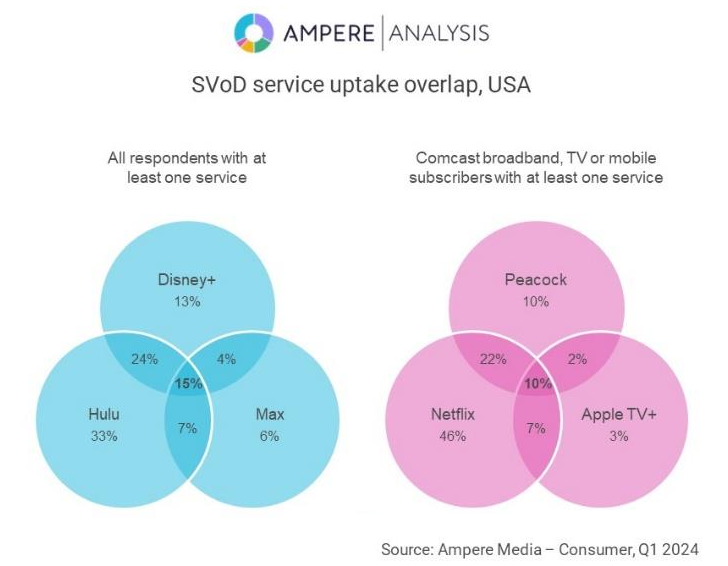

Bundling of streaming services has become increasingly popular in recent weeks with Disney/Warner Bros. Discovery and Comcast all beginning to offer multiple services through a single subscription. Ampere Consumer data indicates there is currently limited overlap in uptake between those services, suggesting great upsell and churn mitigation potential. Is this the future of SVoD subscriber retention?

Key findings

- 42% of US consumers agree with the statement: “I often subscribe, cancel and resubscribe to video-on-demand services so that I only pay when there is something I want to watch”. This ‘resubscriber’ cohort tends to be a younger viewer (18-44 years old), and is more likely to be in family households

- Resubscribers are typically avid media consumers, watching more TV and video each day, stacking more SVoD services, and consuming alternative media formats, such as video games and music services more frequently than the average US consumer. However, this wide media diet also means the cohort is 40% more likely than average to exhibit signs of subscription fatigue and 21% more likely to desire unified access to content across different services (known as ‘aggregation’)

- Ampere’s analysis of email receipt data, via its SVoD Economics US service, indicates that resubscribers to Disney’s Disney+/Hulu/ESPN+ bundle who signed up in Q1 2023 were 59% less likely to churn within a year relative to those who took Disney+ alone. This suggests that bundles are a key tool for mitigating cancel-and-resubscribe activity

- Bundles that include competing streaming services have recently been announced, firstly by Disney and Warner Bros. Discovery and secondly by Comcast to boost subscriber retention

- Ampere’s Q1 2024 Media Consumer data indicates that just 15% of the subscriber base of either Disney+, Hulu or Max currently take all three in the household, and just 10% of Comcast mobile, broadband and TV customers subscribing to Peacock, Netflix or Apple TV+ currently take all three

- Therefore, there is a significant upsell opportunity for a wide audience, who will benefit from expanded content offered by bundled services at discounted rates.

Daniel Monaghan, Research Manager at Ampere Analysis says: “As the SVoD market in the US has become increasingly saturated, new subscribers are harder to find, which makes retention all the more important. There is a sizeable group of consumers who frequently subscribe to SVoD platforms, cancel and resubscribe. Reducing this behaviour would boost platforms’ top and bottom lines. Analysis of Ampere data reveals that churn is far smaller for bundle-takers than non-bundle resubscribers for some offerings.

For instance, resubscribers who took the Disney bundle in Q1 2023 were less than half as likely to churn within a year, compared to standalone Disney+ resubscribers. We’re now seeing competing players following suit and joining forces to bundle their platforms, and our consumer data shows the overlap of uptake for those is currently very limited. This should stand them in good stead to both upsell their services and limit the churn of resubscribers and first-timers alike.”

Note: Ampere’s Q1 2024 Media Consumer survey fieldwork ran between 5th February 2024 and 6th March 2024. Ampere’s SVoD Economics US service analyzes anonymized subscription receipt data from a panel of 3 million opted-in US email users.

Links: Ampere Analysis

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally