LCD TV growth improving, as plasma and CRT TV disappear

Wednesday, April 16th, 2014

Developed region TV demand growth stabilizes, but growth in emerging regions remains soft

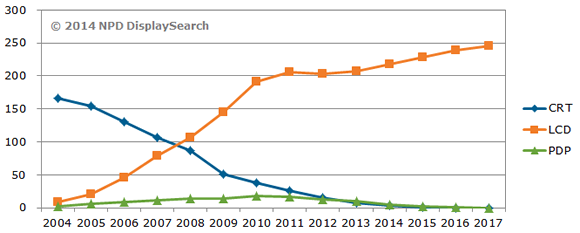

SANTA CLARA, Calif. — Since reaching a peak in 2011, the global TV market has seen continuous declines, falling by 6% in 2012 and by 3% in 2013.LCD TV shipment growth fell into single digits in 2011, experienced its first decline in 2012, and grew by only 2% in 2013, which was not enough to make up for falling shipments of plasma and CRT TVs. With LCD surpassing 90% of global TV shipments, it is the dominant driver of industry growth.

According to the latest TV market forecast published in the NPD DisplaySearch Quarterly Advanced Global TV Shipment and Forecast Report, worldwide TV shipments are projected to grow less than 1% in 2014, but LCD TV shipments will rise almost 5%. Of course, the growth of LCD comes at the expense of plasma and CRT TV shipments, which are forecast to fall 48% and 50%, respectively, in 2014. Both technologies will all but disappear by the end of 2015, as manufacturers cut production of both technologies in order to focus on LCD, which has become more cost competitive. OLED is expected to grow as an alternative flat panel display technology for TVs but is expected to account for less than 1% of shipments through 2017.

“TV shipments worldwide have struggled for the past few years, as several unusual events have disrupted normal buying patterns,” according to Paul Gagnon, director for global TV research at NPD DisplaySearch. “Governments instituted subsidy programs to prop up local economies in the post-recession years from 2009 through 2013, and digital-to-analog broadcast transitions for many developed and emerging countries accelerated demand for TVs further at the expense of future demand.”

Figure 1: Forecast for LCD TV, Plasma TV and CRT TV Unit Shipments

Source: DisplaySearch’s Quarterly Advanced Global TV Shipment and Forecast Report

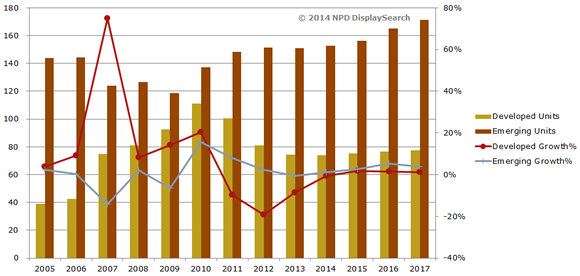

Developed Region Growth Stabilizes, While Emerging Region Growth Remains Soft

The collective emerging regions of the world have long dominated global TV demand. However, at the end of the last decade, TV demand growth surged in developed regions, which included Japan, Western Europe and North America. Much of this increased growth rate was due to analog broadcast shut-off events, as well as rapid cost reductions on flat panel TVs. Japan and other governments also implemented spending programs to boost local demand for energy-efficient TVs and other products. Since then, shipments have declined significantly, as future demand was satisfied during the boom years, though demand has stabilized at around 75 million units annually.

Meanwhile, emerging region growth accelerated from 2009 through 2012, as demand from China skyrocketed, due to several local subsidy programs. With China’s subsidy program now ended and CRT demand falling more quickly than LCD can grow in Asia Pacific and other regions, growth factors have turned distinctly weaker for emerging regions. The World Cup in 2014 and Summer Olympics in 2016, both of which occur in Brazil, will likely have a stimulus effect on many emerging countries. Finally, the end of CRT TV availability will transition purchasing behavior to flat panel TVs.

Figure 2: TV Shipments by Regional Category

Source: DisplaySearch’s Quarterly Advanced Global TV Shipment and Forecast Report

The DisplaySearch Q1’14 Quarterly Advanced Global TV Shipment and Forecast Report, available now, includes panel and TV shipments by region and by size for nearly 60 brands. It also includes rolling 16-quarter forecasts, TV cost/price forecasts, and design wins. For more information about the report, please contact Charles Camaroto at 888-436-7673 or 516-625-2452, e-mail contact@displaysearch.com, or contact your regional NPD DisplaySearch office in China, Japan, Korea or Taiwan.

Latest News

- Barb to start reporting TV-set viewing of YouTube channels

- SAT FILM selects multi-DRM from CryptoGuard

- Qvest and ARABSAT to launch OTT streaming platform

- ArabyAds & LG Ad Solutions partner with TVekstra in Turkey

- Freeview NZ satellite TV service to move to Koreasat 6

- Comscore expands YouTube CTV measurement internationally